EUR/USD

Current level – 1.1026

The currency pair is trading above the static resistance zone at 1.1020, but the breach is still to be confirmed. In case the aforementioned breakthrough becomes valid, a move towards 1.1063 will become more probable, but only a violation of 1.1090 should change the market sentiment to positive. Support levels remain at 1.0970, followed by 1.0940 and the major one at 1.0900. The main driving forces behind price action during the last trading session for this week should be the changes in the consumer price index for the Eurozone (10:00 UK time), as well as the US retail sales data for October (13:30 UK time).

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1065 | 1.1140 | 1.0990 | 1.0900 |

| 1.1090 | 1.1170 | 1.0940 | 1.0880 |

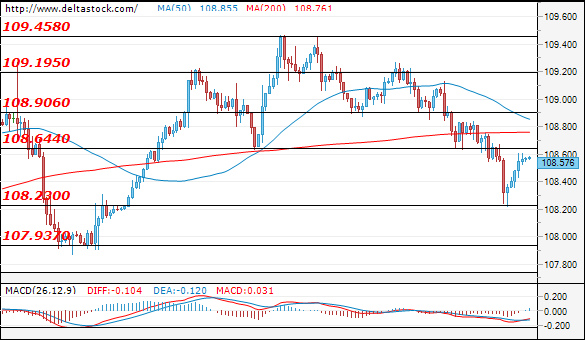

USD/JPY

Current level – 108.57

The successful breakthrough of the support level at 108.64 was of rather corrective nature, with the currency pair recovering the the ground it lost during the past few sessions.. Expectations are to the positive side – for a test of the 108.64 level which now acts as a resistance. The main support is around 107.90 zone

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 108.90 | 109.90 | 108.20 | 107.40 |

| 109.45 | 110.60 | 107.90 | 106.60 |

GBP/USD

Current level – 1.2880

The currency pair consolidated after the successful break of the resistance level at 1.2860 as sentiment remains positive. A move towards the next resistance zone at 1.2910 remains the likely scenario, if there are no negative news regarding Brexit. In negative direction, the main support is at 1.2765.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.2915 | 1.3000 | 1.2820 | 1.2550 |

| 1.2965 | 1.3180 | 1.2760 | 1.2500 |