The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.10209

Open: 1.10527

% chg. over the last day: +0.26

Day’s range: 1.10484 – 1.10646

52 wk range: 1.0884 – 1.1623

EUR/USD currency pair is in a bullish sentiment. The trading instrument has set new local highs. EUR/USD quotes found resistance at the level of 1.10650. 1.10400 is already a mirror support. Sentiment in the financial markets has improved amid optimistic news on the settlement of the trade conflict between Washington and Beijing. White House spokesman Larry Kudlow said the parties are close to a deal. We recommend that you keep track of current information on this issue. The single currency has the potential for further growth. Open positions from key levels.

The Economic News Feed for 18.11.2019 is calm.

The price fixed above 50 MA and 100 MA, which signals the strength of buyers.

The MACD histogram is in the positive zone and continues to rise, indicating a further recovery of the EUR/USD currency pair.

Stochastic Oscillator has started to leave the overbought zone, the %K line is below the %D line, which indicates a bearish sentiment.

Trading recommendations

Support levels: 1.10400, 1.10150, 1.09900

Resistance levels: 1.10650, 1.10900, 1.11000

If the price consolidates above 1.10650, expect further correction to the round level of 1.11000.

Alternatively, the quotes could drop toward 1.10250-1.10000.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.28809

Open: 1.29214

% chg. over the last day: +0.14

Day’s range: 1.29095 – 1.29516

52 wk range: 1.1959 – 1.3385

The GBP/USD currency pair is showing aggressive purchases. Sterling updated key extremes. At the moment, GBP/USD quotes are testing the resistance level of 1.29500. Mark 1.29150 is already a mirror support. A trading instrument has the potential for further growth. We recommend keeping track of up-to-date information regarding the Brexit process. Open positions from key levels.

The news background on the UK economy is calm.

The price fixed above 50 MA and 100 MA, which signals the power of buyers.

The MACD histogram is in the positive zone and above the signal line, which gives a strong signal to buy GBP/USD.

The Stochastic Oscillator is in the neutral zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.29150, 1.28850, 1.28600

Resistance levels: 1.29500, 1.30000

If the price consolidates above 1.29500, expect further growth toward 1.30000.

Alternatively, the quotes could descend toward 1.28900-1.28700.

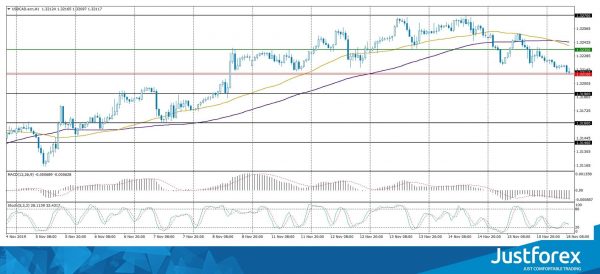

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.32478

Open: 1.32230

% chg. over the last day: -0.18

Day’s range: 1.32097 – 1.32249

52 wk range: 1.2727 – 1.3664

The USD/CAD currency pair is dominated by bearish sentiment. At the moment, Looney is consolidating near key extremes. The trading tool is testing the support level of 1.32100. 1.32350 is the nearest resistance. USD / CAD quotes have the potential to further decline. The Canadian dollar is supported by the positive dynamics of oil quotes. We recommend opening positions from key levels.

The Economic News Feed for 18.11.2019 is calm.

The price fixed below 50 MA and 100 MA, which signals the power of sellers.

The MACD histogram is in the negative zone and continues to decline, which gives a strong signal to sell USD/CAD.

The Stochastic Oscillator is in the neutral zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.32100, 1.31900, 1.31600

Resistance levels: 1.32350, 1.32700

If the price consolidates below 1.32100, further correction of the USD/CAD currency pair is expected toward 1.31800-1.31600.

Alternatively, the quotes could grow toward 1.32600-1.32800.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 108.384

Open: 108.783

% chg. over the last day: +0.31

Day’s range: 108.669 – 108.949

52 wk range: 104.97 – 114.56

The USD/JPY currency pair has moved up. The trading tool has updated local highs. At the moment, quotes are testing a mirror resistance level of 108.900. The 108.650 mark is the immediate support. Demand for safe haven currencies has weakened amid the prospects for resolving a trade conflict between the US and China. We do not exclude further growth of the USD/JPY quotes. We recommend that you pay attention to the dynamics of yield on US government bonds. Open positions from key levels.

The Economic News Feed for 18.11.2019 is calm.

Indicators do not give accurate signals, the price crossed 50 MA and 100 MA.

The MACD histogram is in the positive zone and continues to rise, which gives a strong signal to buy USD/JPY.

The Stochastic Oscillator is in the neutral zone, the %K line is below the %D line, which indicates a bearish sentiment.

Trading recommendations

Support levels: 108.650, 108.400, 108.250

Resistance levels: 108.900, 109.150, 109.300

If the price consolidates above 108.900, expect the quotes to rise toward 109.150-109.300.

Alternatively, the quotes could descend toward 108.500-108.300.