Key Highlights

- This past week, GBP/USD rallied more than 400 pips to trade above 1.3500.

- It is currently correcting lower, but holding key supports above 1.3200.

- The UK Manufacturing PMI in Nov 2019 (Prelim) declined from 48.9 to 47.4.

- The UK Claimant count could change 20.2K in Nov 2019, less than the last 33.0K.

GBP/USD Technical Analysis

This past week, the British Pound rallied above the 1.3200 and 1.3350 resistance levels against the US Dollar. GBP/USD even surged above 1.3420 and spiked above the 1.3500 level.

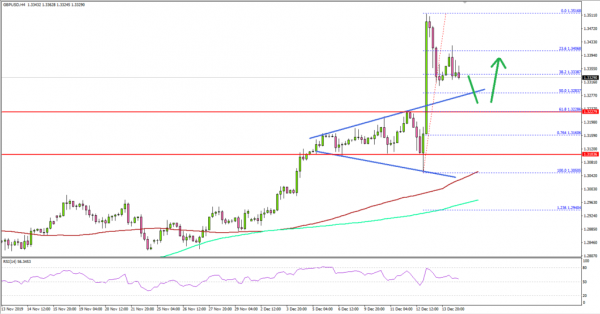

Looking at the 4-hours chart, the pair traded as high as 1.3516 and settled well above both the 100 simple moving average (red) and the 200 simple moving average (green).

Recently, it started a downside correction below 1.3420, plus the 23.6% Fib retracement level of the upward move from the 1.3050 low to 1.3516 high.

However, there are many supports on the downside, starting with 1.3300 and 1.3280. Moreover, the previous connecting resistance trend line might provide support near 1.3285.

Besides, the 50% Fib retracement level of the upward move from the 1.3050 low to 1.3516 high is near the 1.3285 levels. Therefore, dips remain well supported above 1.3280, 1.3250 and 1.3200 in the near term.

On the upside, an initial resistance is near the 1.3285 and 1.3400 levels, above which the pair is likely to accelerate towards 1.3450 and 1.3460.

Fundamentally, the UK Manufacturing Purchasing Managers Index (PMI) (Prelim) for Nov 2019 was released by both the Chartered Institute of Purchasing & Supply and the Markit Economics. The market was looking for an increase from 48.9 to 49.3.

However, the actual result was disappointing, as the UK Manufacturing PMI declined from 48.9 to 47.4 and posted yet another contraction.

The report added:

December data pointed to lower volumes of service sector output and a much sharper drop in manufacturing production, with the latter falling to the greatest extent for almost seven-and-a-half years.

Overall, GBP/USD might correct lower, but it is likely to stay above 1.3280 and 1.3250. Besides, EUR/USD is holding the key 1.1100 support area.

Upcoming Economic Releases

- UK Claimant Count Change Nov 2019 – Forecast 20.2K, versus 33.0K previous.

- UK ILO Unemployment Rate Oct 2019 (3M) – Forecast 3.9%, versus 3.8% previous.

- US Housing Starts Nov 2019 (MoM) – Forecast 1.344M, versus 1.314M previous.

- US Building Permits Nov 2019 (MoM) – Forecast 1.400M, versus 1.461M previous.