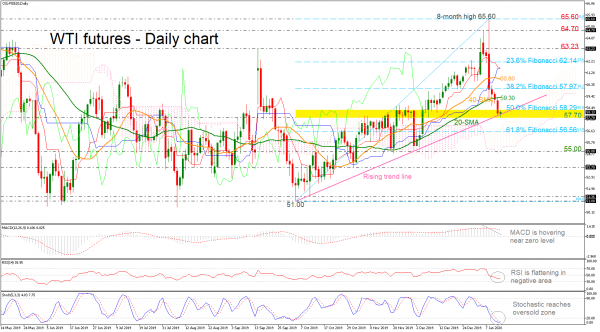

WTI crude oil futures recorded a significant downfall over the past six days after they found strong resistance at the eight-month high of 65.60 last week. Currently, the price is flirting with the ascending trend line around the 57.70 support level, supposing a possible rebound on it or a breakdown.

The negative slope in the RSI, which falls comfortably below its 50 neutral mark, and the downfall of the MACD near its zero line, they are painting a bearish picture for the short-term trading. However, with the stochastic searching for a pullback in the oversold area, it is reasonable to believe that the sell-off may appear short-lived.

The 57.70 number is the nearest support that could reject any attempt lower. If not and the price extends negative momentum, the 61.8% Fibonacci retracement level from 51.00 to 65.60 of 56.56 in the Ichimoku cloud could take over ahead of the 55.00 region

On the flip side, an upside reversal above the 50.0% Fibo of 58.29 could bring the 20-day simple moving average (SMA) of 59.30 back into view. Should it fail to hold, the 38.2% Fibo of 57.97 and the 40-day SMA, currently at 60.80 would be the next targets. A steeper bullish movement could also reach the 23.6% Fibo of 62.14.

In brief, WTI crude oil futures are facing downside pressure near the medium-term diagonal line, with sellers waiting for a decisive close below it to restore optimism over a down-trending market.