The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.11496

Open: 1.11351

% chg. over the last day: -0.12

Day’s range: 1.11310 – 1.11426

52 wk range: 1.0879 – 1.1572

An ambiguous technical picture has developed on the EUR/USD currency pair. Quotes are in lateral movement. At the moment, the local support and resistance levels are 1.11200 and 1.11450, respectively. Greenback demand rose after the publication of optimistic statistics on US retail sales and manufacturing activity in the Philadelphia County. Today, investors also expect the release of important economic releases. We recommend opening positions from key levels.

The Economic News Feed for 17.01.2020:

data on inflation in the eurozone – 12:00 (GMT+2:00);

statistics on the real estate market in the USA – 15:30 (GMT+2:00).

Indicators do not give accurate signals: the price crossed 50 MA and 100 MA.

The MACD histogram is in the negative zone, but above the signal line, which gives a weak signal to sell EUR/USD.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates bullish sentiment.

Trading recommendations

Support levels: 1.11200, 1.10900

Resistance levels: 1.11450, 1.11700, 1.12000

If the price consolidates above 1.11450, expect the quotes to rise toward 1.11700-1.11900.

Alternatively, the quotes could descend toward 1.10900-1.10800.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.30373

Open: 1.30777

% chg. over the last day: +0.29

Day’s range: 1.30641 – 1.30901

52 wk range: 1.1959 – 1.3516

On the GBP/USD currency pair, bullish sentiment prevails. The pound again updated local highs. At the moment, GBP / USD quotes are testing the resistance level of 1.30900. Mark 1.30450 is already a mirror support. A trading instrument has the potential for further recovery. Today, participants in financial markets will evaluate important statistics on the UK economy. We also recommend paying attention to the news background from the USA. Open positions from key levels.

At 11:30 (GMT+2:00), a report on the retail sales in the UK will be published.

The price has fixed above 50 MA and 100 MA, which signals the strength of buyers.

The MACD histogram is in the positive zone, indicating a bullish sentiment.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which also gives a signal to buy GBP/USD.

Trading recommendations

Support levels: 1.30450, 1.30000, 1.29600

Resistance levels: 1.30900, 1.31400, 1.31700

If the price consolidates above the level of 1.30900, further growth of GBP/USD quotes is expected. The potential movement is to 1.31300-1.31600.

An alternative could be a decrease in the GBP / USD currency pair to 1.30200-1.30000.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.30424

Open: 1.30415

% chg. over the last day: -0.03

Day’s range: 1.30389 – 1.30525

52 wk range: 1.2949 – 1.3566

CAD continues to consolidate in a fairly narrow range. Participants in financial markets expect additional drivers. USD / CAD quotes test local support and resistance levels: 1.30350 and 1.30550, respectively. A trading instrument has a downside potential. We are waiting for statistics on the US real estate market. We also recommend that you pay attention to the dynamics of prices of black gold. Open positions from key levels.

The Economic News Feed for 17.01.2020 is calm.

Indicators do not give accurate signals: 50 MA crossed 100 MA.

The MACD histogram is near the 0 mark.

The Stochastic Oscillator is in the neutral zone, the %K line is below the %D line, which indicates a bearish sentiment.

Trading recommendations

Support levels: 1.30350, 1.30200, 1.30000

Resistance levels: 1.30550, 1.30750, 1.31000

If the price consolidates below 1.30350, expect the quotes to fall toward 1.30000-1.29800.

Alternatively, the quotes could grow toward 1.30750-1.31000.

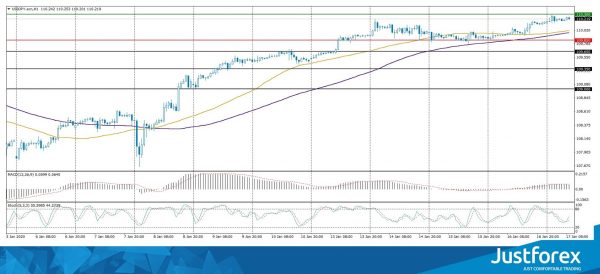

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 109.899

Open: 110.138

% chg. over the last day: +0.27

Day’s range: 110.138 – 110.290

52 wk range: 104.45 – 113.53

On the USD/JPY currency pair, purchases still prevail. The trading instrument has set new local highs. At present, the currency of the “safe haven” is consolidating near the resistance level of 110.300. 109.850 is the immediate support. USD/JPY quotes have the potential for correction after a long rally. We recommend that you pay attention to the dynamics of yield on US government bonds. Open positions from key levels.

The publication of important economic releases from Japan is not planned.

Indicators point to the strength of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone, which signals a bullish mood.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which gives a signal to buy USD/JPY.

Trading recommendations

Support levels: 109.850, 109.650, 109.350

Resistance levels: 110.300, 110.600

If the price consolidates above 110.300, expect further growth toward 110.600-110.800.

Alternatively, the quotes could correct toward 109.600-109.400.