Key Highlights

- USD/JPY failed to stay above 110.00 and started a downside correction.

- There was a break below a contracting triangle with support near 109.88 on the 4-hours chart.

- The US CPI increased 2.5% in Jan 2020 (YoY), more than the 2.4% forecast.

- The US Retail Sales is likely to increase 0.3% in Jan 2020 (MoM).

USD/JPY Technical Analysis

This past week, the US Dollar climbed above the 109.50 resistance area against the Japanese Yen. USD/JPY traded as high as 110.13, but it struggled to stay above the 110.00 area.

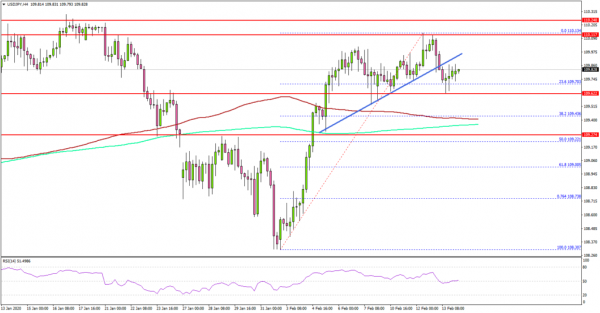

Looking at the 4-hours chart, the pair started a downside correction from the 110.13 swing high. It broke the 109.80 support level to enter a short term bearish zone.

Moreover, there was a break below a contracting triangle with support near 109.88. The pair even spiked below the 23.6% Fib retracement level of the upward move from the 108.30 low to 110.13 high.

However, the 109.60 area is currently acting as a decent support. The main support is near the 109.20 level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

Besides, the 50% Fib retracement level of the upward move from the 108.30 low to 110.13 high is near the 109.20 support area. Therefore, dips towards the 109.20 might find a strong buying interest.

On the upside, the 110.00 and 110.20 levels are important hurdles for the bulls. A successful close above 110.20 could open the doors for more upsides in the near term.

Fundamentally, the US Consumer Price Index for Jan 2020 was released by the US Bureau of Labor Statistics. The market was looking for a 2.4% rise in the CPI in Jan 2020, compared with the same month a year ago.

The actual result was above the forecast, as the US CPI increased 2.5% (YoY). Besides, the monthly change was +0.1%, less than the market forecast of +0.2%.

The report added:

The index for all items less food and energy rose 0.2 percent in January after increasing 0.1 percent in December. Along with the indexes for shelter and medical care, the indexes for apparel, recreation, education, and airline fares all increased in January.

Overall, USD/JPY remains well supported on dips towards 109.20. Looking at EUR/USD, the pair fell sharply below the 1.0900 support. Conversely, GBP/USD recovered above the 1.3000 resistance.

Upcoming Economic Releases

- Euro Zone GDP Q4 2019 (Preliminary) (QoQ) – Forecast 0.1%, versus 0.1% previous.

- US Retail Sales Jan 2020 (MoM) – Forecast +0.3%, versus +0.3% previous.

- US Industrial Production Jan 2020 (MoM) – Forecast -0.2%, versus -0.3% previous.