EUR/USD

Current level – 1.0791

The pair continued to trade in the narrow range between 1.0780 and 1.0810, but the euro is expected to continue losing ground against the greenback. In case the bottom border of the range is breached, the move to the downside should gain momentum, taking the price to the next important support at 1.0670. Any moves to the upside should be limited to the resistance at around 1.0830. The currency pair might be affected by the Preliminary manufacturing PMI for Germany (08:30 GMT) and the CPI data for the Eurozone (10:00 GMT) and, if the data is worse than expected, we might see the common currency lose even more ground.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.0830 | 1.0940 | 1.0780 | 1.0700 |

| 1.0870 | 1.0970 | 1.0700 | 1.0670 |

USD/JPY

Current level – 111.98

Although slowing down, the currency pair continued to rise and is expected to test the resistance at 112.40. With the coronavirus back on the agenda, a move towards the minor support levels are at 111.10 is not excluded. We expect that 110.00 should stop any sell-offs.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 112.40 | 113.70 | 111.10 | 109.60 |

| 113.70 | 114.70 | 110.00 | 108.30 |

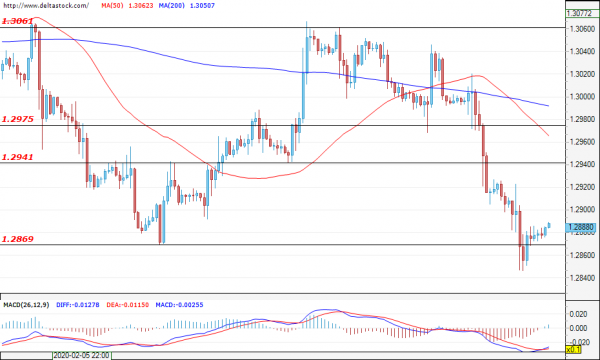

GBP/USD

Current level – 1.2888

The currency pair is trading slightly above the support at 1.2870 after yesterday’s failed attempt to breach it. Expectations are for a second test at 1.2870 which, if successful, could draw a more bearish picture. In case the support at 1.2870 holds, a test of the resistance at 1.2940 would be the most likely scenario. The currency pair might be affected by the UK Preliminary Manufacturing PMI data (09:30 GMT).

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.2925 | 1.3150 | 1.2870 | 1.2870 |

| 1.3060 | 1.3200 | 1.2770 | 1.2770 |