The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.09119

Open: 1.06560

% chg. over the last day: -2.64

Day’s range: 1.06547 – 1.08306

52 wk range: 1.0777 – 1.1494

The EUR/USD currency pair has stabilized after a significant drop. The sentiments of financial market participants improved slightly amid the global support measures taken by the central banks. At the moment EUR/USD quotes are consolidating. The key support and resistance levels are 1.06550 and 1.08200, respectively. Technical correction is not ruled out in the nearest future. We recommend opening positions from key levels.

At 16:00 (GMT+2:00) data on the existing home sales in US will be published.

Indicators do not give accurate signals: the price tests 50 MA, which is currently a dynamic resistance.

Histogram of MACD started to rise, which indicates a possible correction of the EUR/USD currency pair.

The Stochastic Oscillator is located in the overbought zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.06550, 1.06000

Resistance levels: 1.08200, 1.09550, 1.10600.

If the price fixes above 1.08200, expect the qutoes to correct toward 1.09000-1.09700

Alternatively, the quotes could descend toward the round 1.06000.

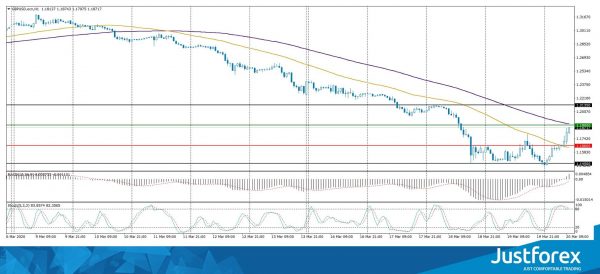

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.15803

Open: 1.14620

% chg. over the last day: -1.04

Day’s range: 1.14096 – 1.18765

52 wk range: 1.1466 – 1.3516

GBP/USD quotes went up after a significant collapse. Pound has updated local highs. At the moment the trading instrument is testing the round level 1.19000. The mark 1.16600 is the nearest support. The GBP/USD currency pair has a potential for further correction. We recommend you to monitor the current information about the spread of the virus COVID-19. Open positions from key levels.

The news background on the UK economy is calm.

Indicators do not give accurate signals: the price has crossed 50 MA and 100 MA.

MACD has moved to the positive zone, which indicates the correction of the currency pair GBP/USD.

The Stochastic Oscillator is located in the overbought zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.16600, 1.14500

Resistance levels: 1.19000, 1.21350

If the price fixes above the round level of 1.19000, expect a correction toward 1.19000.

Alternatively, the quotes could descend toward 1.15000-1.14000.

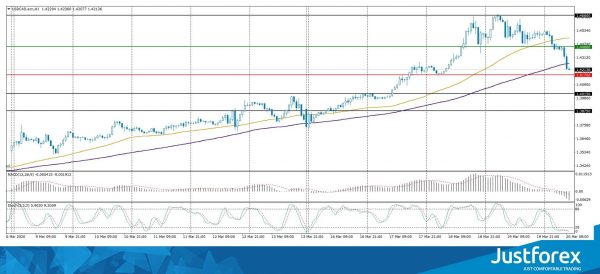

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.45086

Open: 1.45003

% chg. over the last day: -0.06

Day’s range: 1.42074 – 1.45359

52 wk range: 1.2949 – 1.4668

The USD/CAD currency pair shows a correction movement after a prolonged rally. The quotes have updated the local lows. The CAD is supported by the “black gold” price recovery. At the moment the trading instrument is testing the level of 1.41700. The round level 1.44000 is already a “mirror” resistance. The USD/CAD currency pair has a potential for further decline. Open positions from key levels.

At 14:30 (GMT+2:00) Canada will publish a report on retail sales.

Indicators do not give accurate signals: the price has crossed 100 MA.

MACD histogram is in the negative zone, which indicates further correction of USD/CAD quotes.

The Stochastic Oscillator is located in the oversold area, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.41700, 1.40150, 1.38750

Resistance levels: 1.44000, 1.46600

If the price fixes below 1.41700, expect a correction toward 1.40200-1.39000.

Alternatively, the quotes could grow toward 1.45000-1.46000.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 108.042

Open: 110.888

% chg. over the last day: +2.16

Day’s range: 109.329 – 111.359

52 wk range: 101.19 – 112.41

USD/JPY currency pair shows a pronounced upward trend. The quotes have renewed the local highs. Demand for safe haven currencies has weakened. At the moment the trading instrument is testing the “mirror” support level 109.500. The mark 111.300 is the nearest resistance. USD/JPY quotes have potential for further growth. We recommend you to pay attention to the dynamics of the US government securities yield. Open positions from key levels.

The Economic News Feed for 20.03.2020 is calm.

The indicators signal the power of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy USD/JPY.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates a bullish sentiment.

Trading recommendations

Support levels: 109.500, 108.500, 107.850.

Resistance levels: 111.300, 112.000

If the price fixes above 111.300, expect further growth.

Alternatively, the quotes could descend toward 108.500-107.500.