The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.07851

Open: 1.08831

% chg. over the last day: +0.86

Day’s range: 1.08701 – 1.09399

52 wk range: 1.0777 – 1.1494

The EUR/USD currency pair went up after a long consolidation. The trading tool has updated local highs. At the moment, EUR/USD quotes are consolidating in the range of 1.08800-1.09550. The technical pattern signals a further recovery of the EUR. The US Senate supported the $2 trillion bill, which aims to help the unemployed and industries affected by the epidemic of the COVID-19 virus. Today, investors will evaluate the data on the number of initial jobless claims in the United States. According to forecasts, the indicator grew by more than 3.5 times. We recommend opening positions from key levels.

The Economic News Feed for 26.03.2020:

GDP Report (US) – 14:30 (GMT+3:00);

Initial Jobless Claims (US) – 14:30 (GMT+3:00);

Indicators signal the power of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone, indicating a bullish sentiment.

The Stochastic Oscillator is in the neutral zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.08800, 1.08150, 1.07500

Resistance levels: 1.09550, 1.10600

If the price consolidates above 1.09550, expect further correction to 1.10000-1.10500.

Alternatively, the quotes could descend toward 1.08200-1.07800.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.17432

Open: 1.18744

% chg. over the last day: +1.09

Day’s range: 1.17755 – 1.19609

52 wk range: 1.1466 – 1.3516

An ambiguous technical picture has developed on the GBP/USD currency pair. The Pound is currently consolidating. The local support and resistance levels are 1.17800 and 1.19750, respectively. Investors took a wait and see attitude before the meeting of the Bank of England. We recommend you to pay attention to the comments and rhetoric of the representatives of the regulator. Open positions from the key levels.

UK National Statistics Service released weak UK retail sales data for February. At 14:00 (GMT + 2: 00) the Bank of England will announce its decision regarding the key interest rate.

Indicators signal the power of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone, indicating a bullish sentiment.

The Stochastic Oscillator is in the neutral zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.17800, 1.16500, 1.14500

Resistance levels: 1.19750, 1.21350, 1.22800

If the price consolidates above 1.19750, GBP/USD is expected to rise to 1.21000-1.21500.

Alternatively, the quotes could descend toward 1.16500-1.16000.

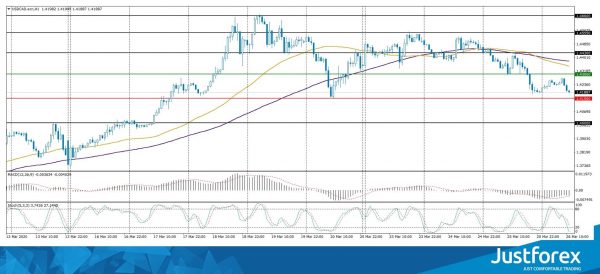

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.45076

Open: 1.44658

% chg. over the last day: -0.25

Day’s range: 1.42955 – 1.44830

52 wk range: 1.2949 – 1.4668

The USD/CAD currency pair went down. The trading tool has updated local lows. CAD is currently testing a round level of 1.43000. 1.44500 is the nearest resistance. The technical picture signals a further correction of the USD/CAD quotes. We recommend you to pay attention to the dynamics of black gold prices. Open positions from key levels.

The Economic News Feed for 26.03.2020 is pretty calm.

Indicators signal the power of sellers: the price has fixed below 50 MA and 100 MA.

The MACD histogram is in the negative zone and continues to decline, indicating a bearish mood.

The Stochastic Oscillator is in the oversold zone, the% K line crossed the% D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.43000, 1.41500, 1.40000

Resistance levels: 1.44500, 1.45550, 1.46600

If the price consolidates below 1.43000, expect further correct toward 1.42000-1.41000.

Alternatively, the quotes could grow toward 1.45000-1.46000.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 111.222

Open: 111.328

% chg. over the last day: +0.05

Day’s range: 110.752 – 111.568

52 wk range: 101.19 – 112.41

The USD/JPY currency pair is still in a flat. There is no defined trend. Participants in financial markets expect additional drivers. At the moment, the following local support and resistance levels can be distinguished: 110.200 and 111.600, respectively. In the near future, technical correction of the trading instrument is not ruled out. We recommend you to pay attention to the dynamics of yield on US government bonds. Open positions from key levels.

The Economic News Feed for 26.03.2020 is calm.

Indicators do not give accurate signals: the price is consolidating near 50 MA.

The MACD histogram is in the positive zone, indicating a bullish sentiment.

The Stochastic Oscillator is in the neutral zone, the% K line crossed the% D line. There are no signals at the moment.

Trading recommendations

Support levels: 110.200, 109.300, 108.500.

Resistance levels: 111.600, 112.000

If the price consolidates below 110.200, expect a correction toward 109.300-108.500.

Alternatively, the quotes could grow toward 112.000-112.500.