Key Highlights

- USD/JPY is slowly moving into a bearish zone and trading below 108.00.

- There is a key support near 106.50, below which the pair could accelerate its decline.

- The US Initial Jobless Claims increased to 6648K in the week ending March 28, 2020.

- The US nonfarm payrolls could decline 100K in March 2020.

USD/JPY Technical Analysis

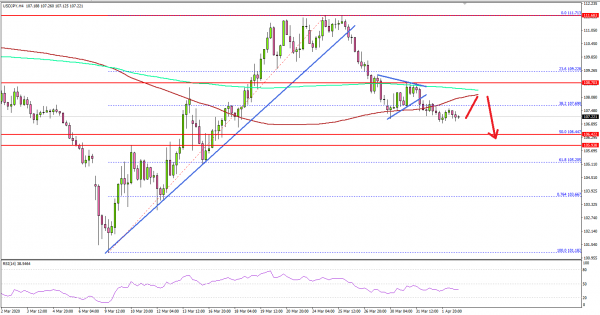

After trading as high as 111.71, the US Dollar started a fresh decline against the Japanese Yen. USD/JPY broke the key 108.70 support area to move into a short-term bearish zone.

Looking at the 4-hours chart, the pair traded below the 108.00 support level and the 100 simple moving average (red, 4-hours). Besides, there was a break below the 23.6% Fib retracement level of the key upward move from the 101.18 low to 111.71 high.

On the downside, there is a key support forming near the 106.50 level. It is close to the previous breakout resistance and now coincides with the 50% Fib retracement level of the key upward move from the 101.18 low to 111.71 high.

If the pair fails to stay above the 106.50 support area, the pair is likely to accelerate its decline below the 106.20 and 106.00 levels.

On the upside, there is a major resistance forming near the 108.70 area and the 200 simple moving average (green, 4-hours). A successful close above the 108.70 level is likely to open the doors for a decent upward move towards the 110.00 and 111.00 levels.

Fundamentally, the US Initial Jobless Claims figure for the week ending March 28, 2020 was released by the US Department of Labor. The market was looking for an increase in claims from 3283K to 3500K.

The actual result was very disappointing as the US Initial Jobless Claims increased to 6648K, up more than 3K from the last reading.

The report added:

The COVID-19 virus continues to impact the number of initial claims. Nearly every state providing comments cited the COVID-19 virus. States continued to identify increases related to the services industries broadly, again led by accommodation and food services.

Overall, USD/JPY could decline further if it fails to stay above 106.50. Looking at EUR/USD, the pair gained bearish momentum below 1.0940, while GBP/USD is still holding above key supports.

Upcoming Economic Releases

- Germany’s Services PMI for March 2020 – Forecast 34.3, versus 34.5 previous.

- Euro Zone Services PMI for March 2020 – Forecast 28.4, versus 28.4 previous.

- UK Services PMI for March 2020 – Forecast 34.8, versus 35.7 previous.

- US Services PMI for March 2020 – Forecast 39.1, versus 39.1 previous.

- US nonfarm payrolls March 2020 – Forecast -100K, versus 273K previous.

- US Unemployment Rate March 2020 – Forecast 3.8%, versus 3.5% previous.