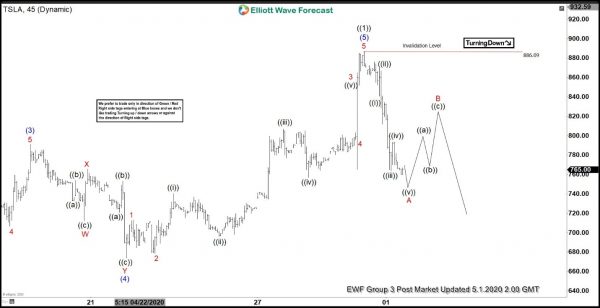

Short Term Elliott Wave outlook in Tesla (TSLA) suggests the stock ended cycle from March low at 886.09 as wave ((1)). Internal of wave ((1)) unfolded as a 5 waves impulsive Elliott Wave structure. Up from 3.19.2020 low, wave (1) ended at 569 and pullback in wave (2) ended at 446.4. Tesla then continues higher in wave (3) towards 791 and wave (4) pullback ended at 673.79. The 45 minutes chart below shows a part of the impulsive move from wave (3). The stock then pullback in wave (4) to 673.79 as a double three. Down from 791, wave W ended at 712.21, wave X ended at 765.57, and wave Y ended at 673.79.

Final wave (5) has also ended at 886.09 as an impulsive structure in lesser degree. Up from 73.79, wave 1 ended at 712.77 and wave 2 pullback ended at 678.50. Wave 3 ended at 845, dips in wave 4 ended at 796.01, and final wave 5 ended at 886.09. The last move completed wave (5) and ended cycle from 3.19.2020 low in wave ((1)). Near term, while bounce stays below there, expect stock to continue lower to correct cycle from March 19 low in 3, 7, or 11 swing before the rally resumes.

TSLA 45 Minutes Elliott Wave Chart