Key Highlights

- EUR/USD started an upside correction from the 1.0765 support zone.

- It surpassed a short term declining channel with resistance at 1.0820 on the 4-hours chart.

- The US nonfarm payrolls decreased 20500K in April 2020, less than the 22000K forecast.

- The US unemployment rate increased sharply from 4.4% to 14.7% in April 2020.

EUR/USD Technical Analysis

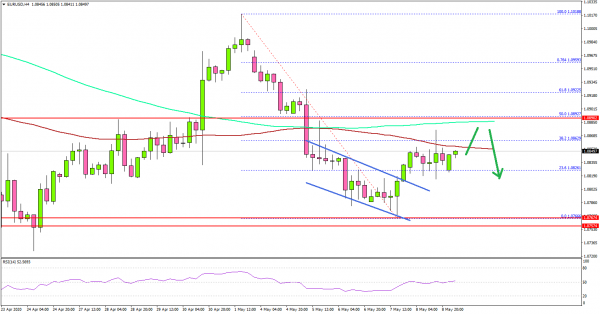

After a steady decline, the Euro found support near the 1.0765 zone against the US Dollar. As a result, EUR/USD started an upside correction above 1.0820, but it is facing many hurdles near 1.0900.

Looking at the 4-hours chart, the pair traded to a new monthly low at 1.0766 and settled well below both the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

Recently, the pair started a decent recovery wave and climbed above the 1.0800 resistance. Besides, there was a break above a short term declining channel with resistance at 1.0820.

The pair even spiked above the 38.2% Fib retracement level of the downward move from the 1.1018 high to 1.0766 low. On the upside, there is a major resistance forming near the 1.0890 and 1.0900 levels.

The 50% Fib retracement level of the downward move from the 1.1018 high to 1.0766 low is also near 1.0890 and the 200 simple moving average (green, 4-hours).

Therefore, EUR/USD must break the 1.0900 resistance area to move into a positive zone. If it fails to continue above 1.0890 or 1.0900, there are chances of a fresh decrease towards the 1.0800 and 1.0765 levels in the near term.

Fundamentally, the US nonfarm payrolls figure for April 2020 was released this past Friday by the US Bureau of Labor Statistics. The market was looking for a decline in jobs by 22000K.

The actual result was slightly better than the forecast as the US nonfarm payroll employment fell by 20.5 million in April. Moreover, the US unemployment rate increased sharply from 4.4% to 14.7%.

The report added:

- The changes in these measures reflect the effects of the coronavirus (COVID-19) pandemic and efforts to contain it. Employment fell sharply in all major industry sectors, with particularly heavy job losses in leisure and hospitality.

- Overall, EUR/USD could either rally above 1.0900 or it might fail and resume its decline towards the 1.0765 low in the coming days.