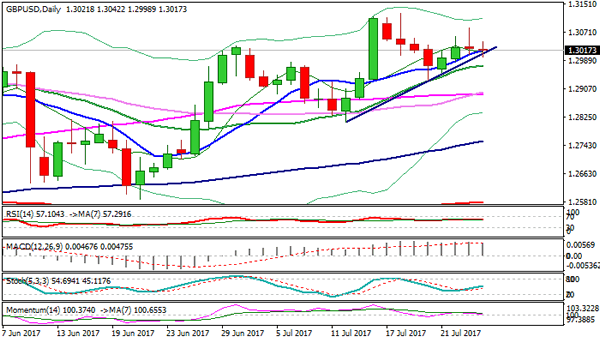

Cable is in defensive on Wednesday after previous day’s strong upside rejection under 1.3100 barrier, where strong three-day rally stalled.

Tuesday’s Doji candle with long upper wick was negative signal with the pair coming under additional pressure after UK GDP data matched expectations.

Fresh weakness cracked 1.3000 support (also bull-trendline connecting 1.2811 and 1.2932 lows) and near 1.2990 (Fibo 61.8% of 1.2932/1.3083 upleg) which mark strong support zone, break of which would trigger further easing.

Near-term studies are turning into bearish setup and see risk of fresh downside.

Below 1.3000/1.2990, next pivot lies at 1.2968 (4-hr cloud base) loss of which would expose key near-term support at 1.2932 (20 July trough).

Conversely, regain of pivotal barrier at 1.3051 (Fibo 61.8% of 1.3125/1.2932) would sideline downside risk and shift near-term focus higher.

Res: 1.3042, 1.3051, 1.3083, 1.3100

Sup: 1.2990, 1.2968, 1.2932, 1.2896