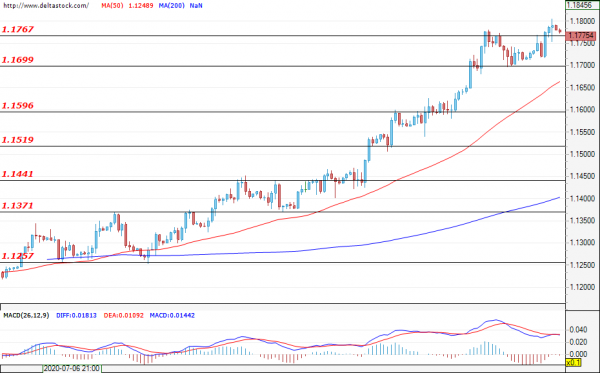

EUR/USD

Current level – 1.1754

The bulls remain in control after the Federal Reserve left rates unchanged and the EUR/USD is headed for a new test of the resistance zone at 1.1810. At the time of writing the analysis, the price is holding firmly over the 1.1767 zone and a further positive push will confirm the breach and easily lead the European currency towards new gains and a test of the next close resistance zone at 1.1810, followed by the one at 1.1930. If the bears prevail, the decline should be limited to the support zone at 1.1699. Only a breach of the lower support of 1.1441 could lead to a change in the current market sentiment

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1810 | 1.1930 | 1.1699 | 1.1520 |

| 1.1930 | 1.2000 | 1.1596 | 1.1440 |

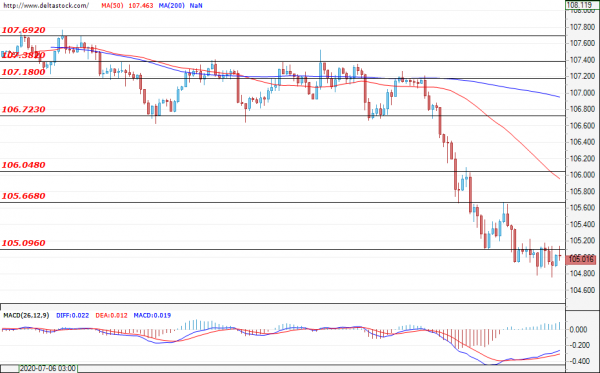

USD/JPY

Current level – 105.01

The price continues to consolidate just under the support zone of 105.09. The ongoing depreciation of the dollar against the other major currencies could help the bears push the USD/JPY towards the lows around 104.45 and, possibly, around 102.30. If the bulls re-enter the market, their first resistance zone will lie at the level of 105.66, followed by the next target of 106.04.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 105.09 | 106.72 | 104.00 | 103.10 |

| 105.66 | 107.38 | 103.10 | 102.00 |

GBP/USD

Current level – 1.2974

The test of the resistance zone at 1.2946 was successful for the Cable and now the price is consolidating around the current level of 1.2974. A further positive push by the bulls and a successful breakthrough of the next target at 1.2480 could bring new gains for the GBP/USD and head the currency towards 1.3100. If buyers’ power turns out to be insufficient, a corrective move could lead to a test of the support zone at 1.2898 and, possibly, the one at 1.2850, if momentum increases.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3050 | 1.3100 | 1.2950 | 1.2846 |

| 1.3100 | 1.3200 | 1.2898 | 1.2760 |