EUR/USD

Current level – 1.1753

The currency pair seems to be entering a correction phase after it reached 1.1908 on Friday, but lost more than a figure just after that and in the early hours of today’s trading session breached the support at 1.1770. The correction should be limited to the next support level at 1.1699. The economic news that investors will be keeping an eye on for this week is the announcement of the US nonfarm payrolls change on Friday at 12:30 GMT.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1770 | 1.2080 | 1.1700 | 1.1600 |

| 1.1910 | 1.2200 | 1.1600 | 1.1520 |

USD/JPY

Current level – 106.12

The dollar managed to regain part of the losses against the yen after the pair consecutively breached the resistance levels at 105.09 and 105.66 and, at the time of writing, the USD/JPY is headed for a test at 106.05. In case the test proves to be successful, the next resistances at 106.72 and even at 107.38, would be tested shortly. The first support is at 105.66.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 106.05 | 106.72 | 105.66 | 104.00 |

| 106.72 | 107.38 | 105.10 | 103.10 |

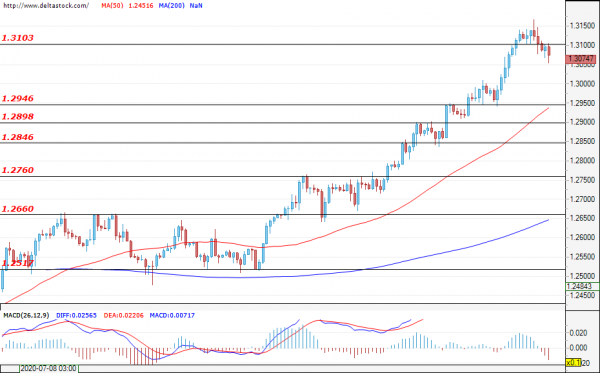

GBP/USD

Current level – 1.3074

Despite stepping back a little at the end of last week, the Cable keeps the uptrend and it’s expected to test again the resistance at 1.3100 which could pave the way to the key resistance at 1.3300. If any corrective move to the downside occurs, it should be limited to the support at 1.2945. Today, the manufacturing PMI data (08:30 GMT) is expected to lead to an increase in volatility.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3100 | 1.3200 | 1.2950 | 1.2846 |

| 1.3200 | 1.3300 | 1.2898 | 1.2760 |