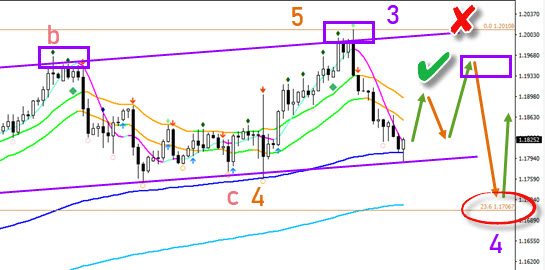

The EUR/USD has reached the major target and round psychological level at 1.20. This round level could be the end of wave 3 and start a large retracement. What’s the next step for this pair?

Price Charts and Technical Analysis

The EUR/USD completed a bearish ABC (pink) retracement as part of the wave 4 (orange). The last push up towards 1.20 has probably completed a wave 5 (orange) of wave 3 (purple). The current impulsive push down is therefore a wave A (orange). But the channel support (purple) and the 144 ema are expected to be a strong support zone. A bullish bounce is expected either now or at the 23.6% Fibonacci level.

A bullish bounce should take place in 3 waves, if price action is forming a wave B (orange). Price could move up towards the head and shoulders level (purple boxes), which in turn is expected to act as resistance. The main targets are the Fibonacci retracement levels (red circles). Only a break above the channel top and 1.20 target would make the bearish pullback less likely (red x)