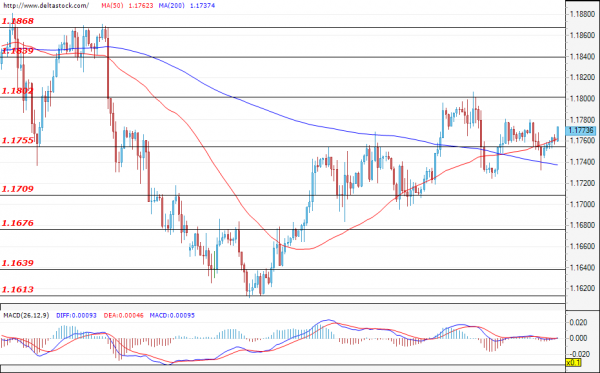

EUR/USD

Current level – 1.1773

At the time of writing, the currency pair continues to trade in the narrow range of 1.1700 – 1.1800. A breach of either boundary of the channel could be decisive for the direction of the subsequent movement. The main obstacle for the bears is the not-so-distant support zone at 1.1613, and only a breach of this level could indicate absolute dominance on part of the bears. On the other hand, given the larger time frames, a breach of the level at 1.1870 would give investors an additional incentive to push the price up to 1.2000, and then further up to 1.2200.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1800 | 1.1840 | 1.1709 | 1.1640 |

| 1.1840 | 1.1870 | 1.1676 | 1.1610 |

USD/JPY

Current level – 105.83

The appreciation of the dollar since the beginning of the trading week was thwarted around the resistance level at 106.00. It is quite possible that we will see additional price reductions should we witness unsuccessful negotiations and postponement of the additional fiscal stimulus by the White House. The first important support for the currency pair is the level of 105.00. In a positive scenario, in which we observe a return to bullish sentiment and a successful breach of 106.00, we may expect a bullish attack of the levels around 108.00 – 109.00.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 106.00 | 106.50 | 105.80 | 105.40 |

| 106.50 | 107.20 | 105.50 | 104.80 |

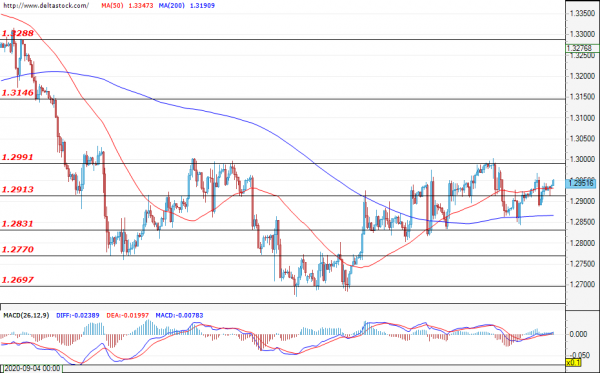

GBP/USD

Current level – 1.2951

Once again we witnessed an unsuccessful breach of the resistance zone at 1.2990, as the currency pair continues to consolidate within the range 1.2830 – 1.2990. The pound is at risk of facing serious sell-offs in the long run, fueled by aggravating Brexit talks, with the final deadline being set for the 31st of December. At the time of writing, the sentiment is rather negative, especially given the faster recovery of the U.S. economy and the appreciation of the U.S. dollar.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.2991 | 1.3050 | 1.2913 | 1.2770 |

| 1.3050 | 1.3146 | 1.2831 | 1.2700 |