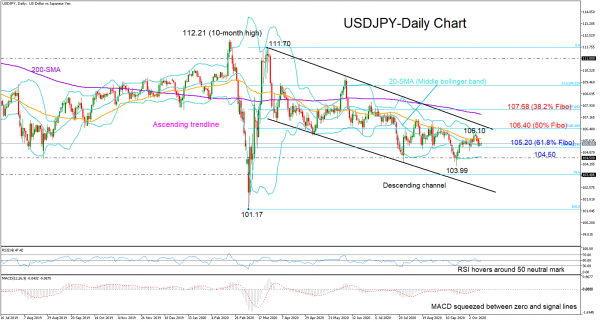

USDJPY stabilized within the 105.00 area and around the 20-day simple moving average (SMA) following the rejection of the 106.10 level and the upper Bollinger band earlier this week.

The momentum indicators are directionless, suggesting a neutral short-term bias as the RSI is hovering around its 50 level and the MACD is squeezed between its zero and signal lines.

Nevertheless, a step below the middle Bollinger band (105.20), which is also the 20-day SMA, may generate additional losses towards the lower Bollinger band and the 104.50 support region. Lower, the bears may re-challenge the 103.99 trough with scope to stretch the downward pattern in the medium-term picture to the base of the descending channel.

Alternatively, if the pair refuses to cross below the 20-day SMA, where the 61.8% Fibonacci of the 101.17-111.70 upleg is also located, the spotlight will shift back to last week’s high of 106.10. It is also worthy to note that the price is trading closer to the surface of the channel, increasing the case of a positive breakout that may see the breach of the 50% Fibonacci of 106.40 and an extension towards the 200-day SMA and the 38.2% Fibonacci of 107.68.

Summarizing, USDJPY continues to look neutral in the short-term, facing immediate support and resistance within the 105.20 and 106.10 boundaries. In the medium-term timeframe, the pair maintains a bearish trend within a descending channel.