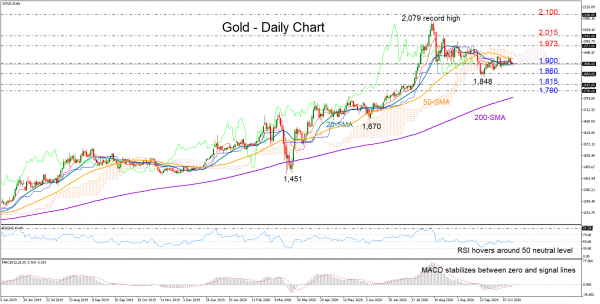

Gold completed another indecisive week, maintaining a horizontal trajectory within the 1,848-1,930 area as the final countdown to the US election nears an end, the stimulus confusion remains intact, and vaccine hopes rise.

The technical indicators justify the sideways move in the price, with the RSI remaining muted around its 50 neutral mark and the MACD stabilizing between its zero and signal lines.

On the downside, the 1,900 level is a crucial barrier to watch, especially in the weekly chart as this is where the supportive 20-weekly simple moving average (SMA) has set a new trap to the bears. Should it fail to act, the next obstacle could emerge around the 1,860 mark. Another violation at this point may resurface worries of a down-trending market and hence further dampen the outlook, with the price likely seeking its next shelter somewhere between 1,815 and 1,790.

On the upside, the 50-day SMA attracted special attention last week when it rejected upside corrections at 1,925 and pushed the price back below the Ichimoku cloud. That suggests stronger bullish momentum if the market crosses above that line, with resistance likely running up to 1,973 and then near 2,015.

Looking at the big picture, the market continues to follow an uptrend as long as it trades above September’s low of 1,848. The slowdown in the 50-day SMA is reflecting some caution, though since the line is still comfortably above the 200-day SMA, the risk remains skewed to the upside.

In brief, gold is holding a neutral profile in the short-term picture, supported around the 1,860 number. A decisive step below 1,900 may strengthen selling pressure, while a close above the 50-day SMA could boost buying interest.