Key Highlights

- EUR/USD climbed above 1.1850, but it struggled to clear the 1.1900 resistance zone.

- A key bullish trend line is forming with support near 1.1840 on the 4-hours chart.

- The Euro Zone Manufacturing PMI could decline from 54.8 to 53.1 in Nov 2020 (Preliminary).

- The US Manufacturing PMI might also drop from 53.4 to 53.0 in for Nov 2020 (Preliminary).

EUR/USD Technical Analysis

After finding support near 1.1750, the Euro started a fresh increase against the US Dollar. EUR/USD broke the 1.1800 and 1.1850 resistance levels, but it seems to be facing a crucial hurdle.

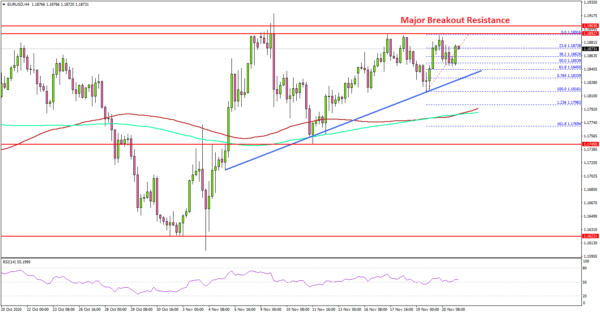

Looking at the 4-hours chart, the pair remained well bid above the 1.1820 pivot level. It even settled above 1.1850, the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

However, the bulls are facing an uphill task near the 1.1900 resistance zone. The recent high was formed near 1.1891 before the pair corrected lower.

On the downside, there are many important supports, starting with 1.1850. There is also a key bullish trend line forming with support near 1.1840 on the same chart. If there is a downside break below the trend line support, the pair could test the 1.1800 support.

The 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours) are also near 1.1795 to act as a strong support. Any further losses may perhaps lead EUR/USD towards the 1.1750 support zone.

On the upside, there is a strong resistance forming near the 1.1895 and 1.1900 levels. To continue higher and started a strong rally, the pair must settle above the 1.1900 resistance zone.

Looking at GBP/USD, the pair is showing positive signs above 1.3250 and it is likely to gain further if it settles above 1.3300. Besides, gold price is holding the $1,850 support, but it is facing a major hurdle near $1,900.

Upcoming Economic Releases

- Germany’s Manufacturing PMI for Nov 2020 (Preliminary) – Forecast 56.5, versus 58.2 previous.

- Germany’s Services PMI for Nov 2020 (Preliminary) – Forecast 46.3, versus 49.5 previous.

- Euro Zone Manufacturing PMI Nov 2020 (Preliminary) – Forecast 53.1, versus 54.8 previous.

- Euro Zone Services PMI for Nov 2020 (Preliminary) – Forecast 42.5, versus 46.9 previous.

- UK Manufacturing PMI for Nov 2020 (Preliminary) – Forecast 50.5, versus 53.7 previous.

- UK Services PMI for Nov 2020 (Preliminary) – Forecast 42.5, versus 51.4 previous.

- US Manufacturing PMI for Nov 2020 (Preliminary) – Forecast 53.0, versus 53.4 previous.

- US Services PMI for Nov 2020 (Preliminary) – Forecast 55.5, versus 56.9 previous.