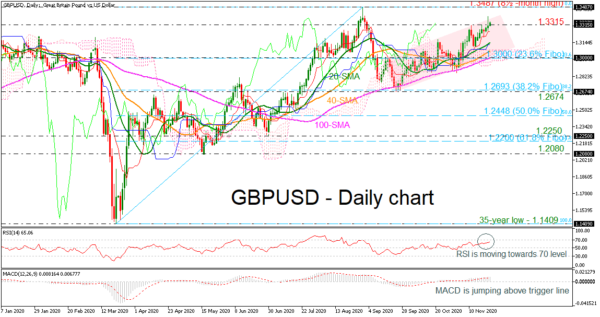

GBPUSD came close to breaking the eight-and-half-month high of 1.3487 on Monday, finishing the day at new three-month high slightly below the 1.3400 handle. Moreover, the price has been developing within an upward sloping channel since September 23, holding above the simple moving averages (SMAs) and the Ichimoku cloud.

According to the RSI, the market could maintain positive momentum in the short-term as the indicator is positively sloped above its neutral threshold of 50, and the MACD oscillator is holding above its trigger and zero lines.

On the upside, the price could attempt to overcome yesterday’s high of 1.3386 and retest the 1.3487 resistance, which if successfully broken the door could open for the 1.3605 barrier, registered on May 2018. Should traders continue to buy the pair above that peak, bringing the long-term uptrend back into play, resistance could then run towards 1.3710, achieved on February 2018.

A reversal to the downside, however, could find immediate support at the 20-day SMA currently at 1.3145, while slightly lower the 1.3060 level, which encapsulates the 40-day SMA and the upper surface of the Ichimoku cloud, could also come into view. If the latter fails to halt bearish movements, the next target could be the crucial 23.6% Fibo of 1.3000, which overlaps with the 100-day SMA and the lower band of the channel. More losses could take the price towards the 38.2% Fibo of 1.2693.

Turning to the long-term view, the outlook has been positive over the past eight months and a decisive close above 1.3487 could strengthen the bullish picture.