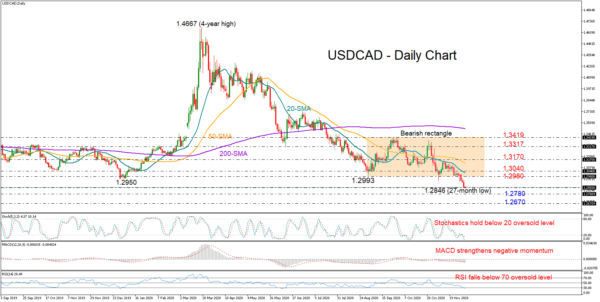

USDCAD brought its downward pattern from the 1.4667 peak back into play after breaching the 1.2980 floor and the base of a rectangle, which kept the market in a sideways move during the past three months.

In its third week of losses, the price is currently trading around a new 27-month low of 1.2846 and comfortably below its simple moving averages (SMA) as the momentum indicators continue to flash a bearish bias. Despite having ticked below their oversold levels, the RSI and the Stochastics have yet to show any signs of reversal. Likewise, the MACD is dipping within the negative territory and below its red signal line.

The spotlight may turn to the 2018-2017 congested zone if selling pressure persists. The 1.2780 restrictive level could come first into view ahead of the 1.2670 barrier, while lower, the next spot could occur around 1.2550.

If the bulls take control around 1.2850, the rectangle’s base at 1.2980 may switch to resistance with the help of the 20-day SMA. A step higher could initially slow around the 50-day SMA and the previous peak of 1.3170 before it gears towards 1.3317.

Summarizing, USDCAD is expected to hold a bearish bias in the short term, though additional losses could be limited as the pair is fluctuating in the oversold zone.

Note that the US nonfarm payrolls and Canada’s employment report are scheduled for release today at 12:30 GMT.