EUR/USD

Current level – 1.2079

The recovery from last week’s losses continued for the single European currency during the first trading session of this week. The sentiment remains positive, for a test and a possible breach of the first significant resistance at 1.2098, which could lead to a test of the next important resistance at 1.2181. Today, there are no planned economic events and news that are expected to affect the market.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.2098 | 1.2155 | 1.2058 | 1.1957 |

| 1.2155 | 1.2181 | 1.2011 | 1.1880 |

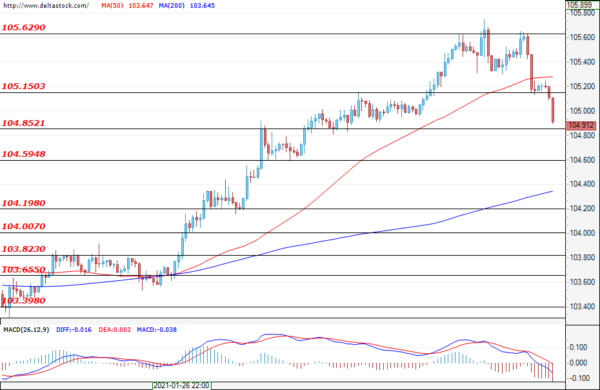

USD/JPY

Current level – 104.91

Buyers were limited to just below the resistance level at 105.62, where the bears took control and directed the movement of the currency pair towards a test of the support level at 104.85. If the U.S. dollar continues to lose ground against the Japanese yen and the breach of the mentioned support is to be confirmed, it could be followed by a deeper sell-off in order for the main support zone at 104.19 to be tested.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 105.15 | 106.70 | 104.85 | 104.19 |

| 105.62 | 107.40 | 104.59 | 104.00 |

GBP/USD

Current level – 1.3776

The currency pair managed to leave the range, formed about two weeks ago by a breach of the main resistance level at 1.3740, which now plays the role of the first important support zone. The breach outlined an entirely bullish scenario for a test of the next significant resistance level at 1.3800, followed by the one at 1.4000. In the event of bear predominance, we may witness trading retrace back to the 1.3633 – 1.3740 range. This, in turn, should not change the positive sentiment of the market participants, unless the bears manage to take the pair to the not-so-near support level at 1.3448.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3780 | 1.3850 | 1.3740 | 1.3542 |

| 1.3850 | 1.4000 | 1.3688 | 1.3448 |