The Australian dollar edged higher in early European trading on Friday, recovering overnight losses after much worse than expected Australia’s retail sales (-1.1% from 0.3% previous and 0.4% forecast).

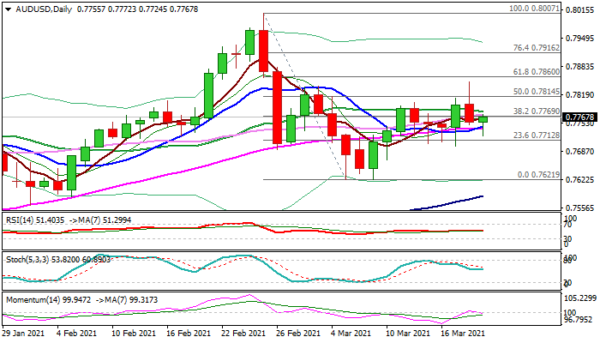

Bounce from Asian low (0.7724) needs to clear pivots at 0.7772/79 (converging 30/20 DMA’s) to shift near-term focus higher and move into the upper side of near-term 0.7699/0.7849 range.

Long shadows of the candles in past few days signal indecision, with clear break of either range boundary to provide clearer direction signal.

Lift above upper pivots at 0.7849/60 (range top / Fibo 61.8% of 0.8007/0.7621) would signal continuation of recovery leg from 0.7621 (Mar 5 low) and expose target at 0.7916 (Fibo 76.4%) violation of which would open way for retest of three-year high at 0.8007.

Conversely, drop below range floor (0.7699) would risk retest of key near-term support at 0.7621.

Daily techs lack signals as rising cloud continues to underpin the action, but momentum studies are weakening and moving averages are in a mixed setup, with weekly Doji candle to add directionless mode.

Res: 0.7779, 0.7810, 0.7840, 0.7860.

Sup: 0.7745, 0.7712, 0.7699, 0.7668.