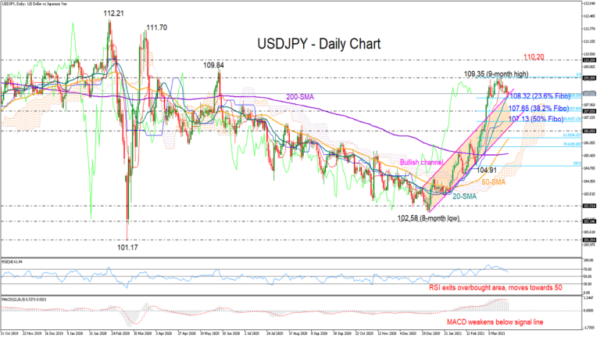

USDJPY’s rally faltered around 109.35, with the price reversing lower to seek support near the 20-day simple moving average (SMA) and the upper boundary of the broken bullish channel at 108.44.

The momentum indicators warrant some caution as the RSI has peaked in the overbought area and is drifting towards its 50 neutral level, while the MACD is decelerating below its red signal line.

Sellers may wait for a decisive close inside the channel and particularly below the 20-day SMA and the 23.6% Fibonacci of the 104.91 – 109.35 up leg at 108.30 to take full control. As such, the pair could plunge towards the 38.2% Fibonacci of 107.65, while beneath that a more crucial support could develop around the 50% Fibonacci of 107.13 and the bottom of the channel.

Alternatively, a bounce near the 20-day SMA and the surface of the channel at 108.44 would resume positive sentiment, shifting the spotlight towards the 109.35 peak. Should the bulls dominate above the latter, strengthening the short- and medium-term outlook, the next obstacle may occur somewhere between 109.84 and 110.20.

In brief, USDJPY is currently facing a weakening positive bias in the short-term picture, though only a break below the 20-day SMA and the 108.30 level could raise the risk of a sharper decline.