Key Highlights

- GBP/USD started a fresh increase above the 1.3800 resistance zone.

- It broke a connecting bearish trend line with resistance near 1.3795 on the 4-hours chart.

- EUR/USD is holding 1.1700, but it is facing a major hurdle near 1.1850.

- The US ISM Service Index climbed from 55.3 to 63.7 in March 2021.

GBP/USD Technical Analysis

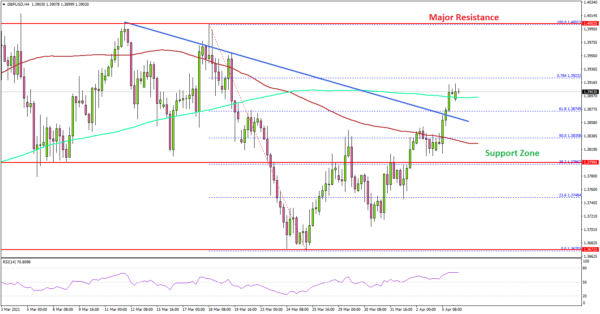

This past week, the British Pound formed a support base above 1.3720 against the US Dollar. GBP/USD started a fresh increase above the 1.3750 and 1.3800 resistance levels.

Looking at the 4-hours chart, the pair traded above a couple of important hurdles near 1.3800. There was also a break above a connecting bearish trend line with resistance near 1.3795 on the same chart.

The pair climbed above the 1.3840 level and the 100 simple moving average (red, 4-hours). It even traded above the 50% Fib retracement level of the downward move from the 1.4001 swing high to 1.3670 low.

The pair is just above the 200 simple moving average (green, 4-hours), and an immediate resistance is near the 1.3915 level and. If there is a close above 1.3915, the pair is likely to continue higher towards the 1.4000 resistance zone.

Conversely, there is a risk of a fresh bearish wave below the 1.3820 and 1.3800 support levels. The next major support is near the 1.3740 level.

Fundamentally, the US ISM Non-Manufacturing (Services) Index was released yesterday by the Institute for Supply Management (ISM). The market was looking for an increase from 55.3 to 58.5.

The actual result was better than the forecast, as the US ISM Non-Manufacturing (Services) Index climbed to 63.7. Besides, the ISM Services New Orders Index rose to 67.2 from 51.9.

The report added:

The March reading indicates the 10th straight month of growth for the services sector, which has expanded for all but two of the last 134 months.

Overall, GBP/USD is showing bullish signs, but it might struggle near 1.4000. Similarly, upsides are likely to be contained near 1.1850 in EUR/USD in the short-term.

Economic Releases

- Euro Zone Sentix Investor Confidence for April 2021 – Forecast 6.5, versus 5.0 previous.

- Euro Zone Unemployment Rate for Feb 2021 – Forecast 8.1%, versus 8.1% previous.