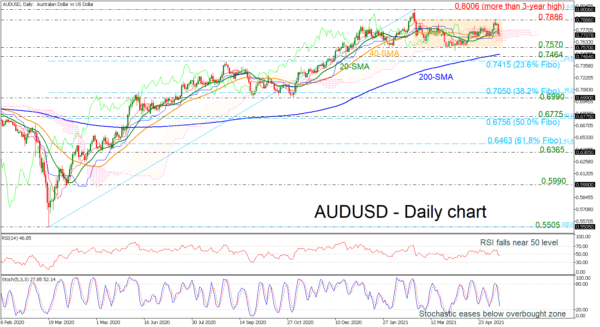

AUDUSD is plunging within a ten-week sideways channel, meeting the Ichimoku cloud and the short-term simple moving averages (SMAs). However, the 200-day SMA is still moving higher, approaching the current market price. The RSI, around the 50 neutral level, is heading south, while the stochastic posted a bearish crossover within the %K and %D lines.

Should prices decline further, an immediate level could be found around 0.7570, an area which has provided crucial support. Then a leg below that, the pair could meet the 200-day SMA, which stands near the 0.7464 barrier, before the focus shifts to the 23.6% Fibonacci retracement level of the up leg from 0.5505 to 0.8006 at 0.7415. Steeper downside moves could open the door for the 38.2% Fibonacci at 0.7050.

If the market manages to pick up speed, the upper boundary of the channel at 0.7886 could offer nearby resistance ahead of the more-than-three-year high of 0.8006. In this case, prices could climb towards the 0.8130 resistance, being the high from January 2018.

Overall, in the short-term, AUDUSD is in a horizontal trajectory but the broader outlook is still bullish, remaining above the 200-day SMA.