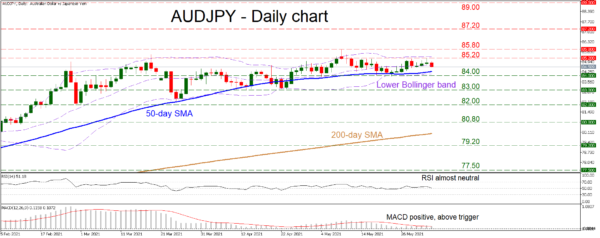

AUDJPY has been trapped in a narrow sideways range for two months now, between 82.00 and 85.80. This marks a consolidation phase within the bigger uptrend that has been in effect for more than a year. A break on either side of this narrow range will reveal the next directional wave for the pair.

The short-term oscillators are stuck near neutral levels, reflecting the absence of any volatility lately. The RSI is marginally above its 50 level, and while the MACD is still positive, it could dip below its red trigger line soon.

In case the bulls retake the wheel, their first target would be the 85.20 high, before the focus turns towards the upper bound of the recent range at 85.80. A break of that zone would signal the continuation of the longer-term uptrend, opening the door for a test of the 87.20 region, marked by the inside swing low back in January 2018.

If sellers take control, the first area to offer support may be around 84.00, which also encapsulates the 50-day moving average and the lower Bollinger band. Stepping lower, the 83.00 level could halt any declines before a tougher barrier appears at the lower end of the range at 82.00. If the bears pierce below, that could turn the bigger picture more neutral, setting the stage for more declines towards 80.80.

In short, a break either above 85.80 or below 82.00 will likely determine where the market goes next.