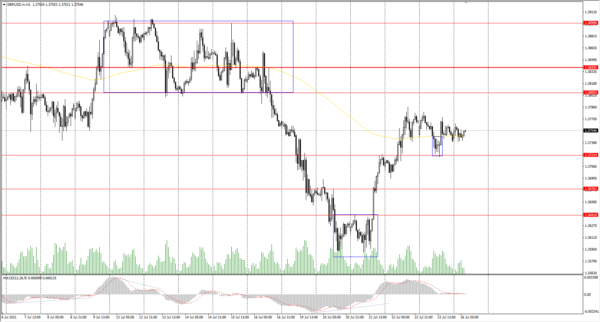

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.1769

Prev Close: 1.1771

% chg. over the last day: +0.02%

Compared to Friday, the situation on the EUR/USD currency pair has not changed. Last week, the ECB hinted at a longer period of monetary support, as a new wave of the coronavirus pandemic could pose a risk to eurozone economic recovery. But Friday’s business activity (PMI) data showed a positive growth trend, jumping to the highest level since June 2006.

Trading recommendations

Support levels: 1.1761, 1.1746, 1.1609

Resistance levels: 1.1822, 1.1834, 1.1879, 1.1934, 1.1969

From the technical point of view, the trend is still bearish. Now the price is trading in a narrow range within a broader 1.1761-1.1823 price range. The negative situation for the European currency remains unchanged, but short-term upward movements are not excluded. In such market conditions, traders should look for the sell positions from the resistance levels. Buy positions can be considered only on the intraday timeframes after the price breaks through the narrow range upwards.

Alternative scenario: if the price breaks through the 1.1879 resistance level and fixes above, the general uptrend is likely to be resumed.

News feed for 2021.07.26:

- Germany Ifo Business Climate Index (m/m) at 11:00 (GMT+3);

- US New Home Sales (m/m) at 17:00 (GMT+3).

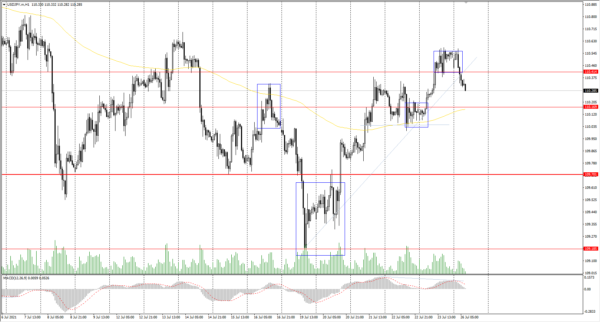

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.3749

Prev Close: 1.3741

% chg. over the last day: +0.06%

The British pound looks more confident than the euro. But due to the rapid spread of the delta strain in the UK and across Europe, economic growth forecasts for July are expected to be weak as more people are forced to self-isolate in accordance with government regulations. Because of a growing shortage of supermarket goods in the UK, food retail staff won’t be quarantined for ten days if someone has been in close contact with the infected person.

Trading recommendations

Support levels: 1.3721, 1.3676 ,1.3641, 1.3614, 1.3525

Resistance levels: 1.3805, 1.3899, 1.3923, 1.4002, 1.4075, 1.4101

The trend on the GBP/USD currency pair is downward on the H1 timeframe. But buyers are still able to keep the course from falling. The MACD indicator has become inactive. Under such market conditions, traders are better to look for both sell deals from the resistance levels within the trend and buy deals from the support levels, but only on the intraday timeframes and with short targets.

Alternative scenario: if the price breaks through the 1.3839 resistance level and consolidates above, the bearish scenario is likely to be canceled.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 110.12

Prev Close: 110.54

% chg. over the last day: +0.38%

The manufacturing activity of Japan showed the weakest growth over the past five months in July as the country is faced with serious challenges because of COVID-19 cases, which are forcing the government to extend restrictions and hinder economic recovery. Meanwhile, the services sector of Japan declined even more sharply in July. The stronger contraction in this sector came on the back of stronger declines in production, new orders, and new export orders.

Trading recommendations

Support levels: 110.17, 109.70, 109.19, 108.65

Resistance levels: 110.41, 110.73, 111.06, 111.48, 110.73, 112.18

In terms of technical analysis, the situation has become uncertain. On the one hand, the price broke through the priority change level on Friday. On the other hand, the price failed to consolidate higher and returned back under the level. Traders are better to consider intraday trading now. For buy positions, it’s better to wait for a pullback to the nearest support level. Sell positions should be considered only from resistance levels and with short targets.

Alternative scenario: if the price falls below 109.70, the downtrend is likely to be resumed.

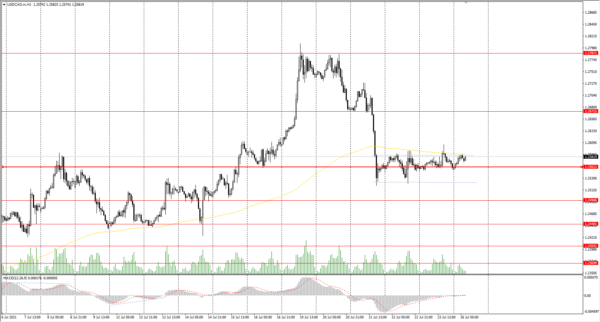

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.2562

Prev Close: 1.2560

% chg. over the last day: -0.01%

The situation with the USD/CAD currency pair has not changed. The Canadian dollar is a commodity currency and is highly dependent on oil price movements. Oil is now trading in the narrow price corridor, causing a consolidation on the USD/CAD currency pair. Analysts expect a short-term downward correction of oil, which will lead to an increase in USD/CAD quotes. Statistical Department of Canada released the data on retail sales on Friday. In May, receipts fell by 2.1% due to the COVID-19 shutdown, but sales increased by 4.4% as restrictions in the country were weakened. Also, the Federal agency reported on creating 230,700 new jobs for June.

Trading recommendations

Support levels: 1.2561, 1.2519, 1.2448, 1.2404, 1.2347, 1.2312

Resistance levels: 1.2671, 1.2787, 1,2951

Technically, the trend remains bullish. But the price is trading right at the priority change level. The MACD indicator is inactive. Traders are better to play it safe and take action only after the price moves to one side of the narrow price range.

Alternative scenario: if the price breaks through the 1.2561 support level and fixes below, the downtrend is likely to be resumed.