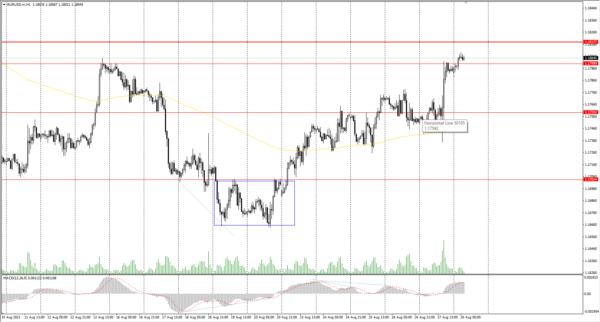

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.1751

Prev Close: 1.1794

% chg. over the last day: +0.36%

The US PCE Price Index declined in July. Manufacturers of cars, domestic appliances, and other goods are challenged with repair parts and labor shortages and are facing higher material costs. After the Jackson Hole symposium, the dollar index is now under pressure, which plays in favor of the stronger euro.

Trading recommendations

Support levels: 1.1799, 1.1759, 1.1704, 1.1620

Resistance levels: 1.1817, 1.1854, 1.1894, 1.1934, 1.1969

From a technical point of view, the general trend of the EUR/USD currency pair is bearish. But the price is trading above the moving average and has approached the priority change level. The MACD is signaling a divergence in the opposite direction. Under such market conditions, it is best to look for sell trades from the resistance levels, where sellers show initiative. Buy trades can only be considered from the support levels where buyers show initiative throughout the day.

Alternative scenario: if the price breaks through the 1.1817 resistance level and fixes above, the mid-term uptrend will likely resume.

News feed for 2021.08.30:

- Germany Consumer Price Index (m/m) at 15:00 (GMT+3);

- Pending Home Sales (m/m) at 17:00 (GMT+3).

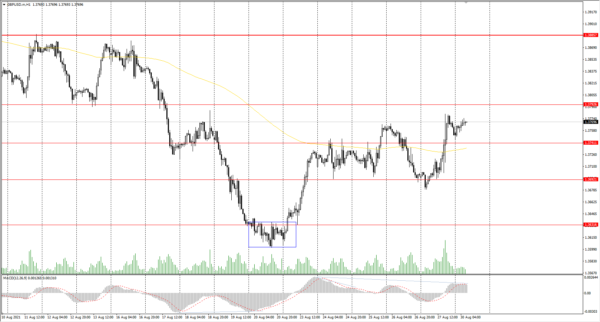

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.3695

Prev Close: 1.3752

% chg. over the last day: +0.42%

Against the background of the dollar index fall, the British pound has partially restored its position. The fundamental picture for the near future looks in favor of the dollar index decrease, so the pound sterling will continue to get stronger. It is the bank holiday in the UK today, so volatility on the GBP/USD currency pair will be low.

Trading recommendations

Support levels: 1.3741, 1.3692, 1.3632, 1.3614, 1.3525

Resistance levels: 1.3793, 1.3772, 1.3886, 1.3935, 1.4002

On the hourly time frame, the GBP/USD trend is bearish but the price is trading above the moving average; the local trend is upward. The MACD indicator became positive, but there is a divergence on the higher timeframe, which indicates an impending downward movement. Under such market conditions, it is better to look for sell trades from the resistance level, where sellers show initiative. Buy positions can be considered only with short targets throughout the day.

Alternative scenario: if the price breaks through the 1.3885 resistance level and consolidates above, the bullish scenario will likely resume.

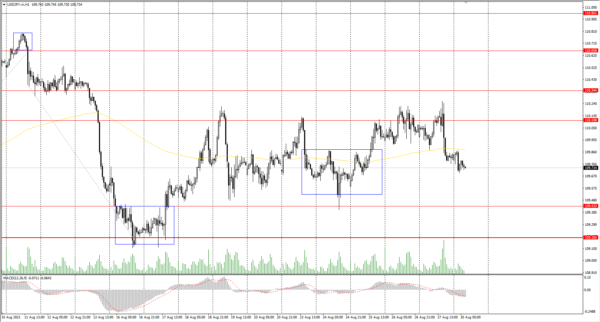

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 109.98

Prev Close: 109.83

% chg. over the last day: -0.14%

Japan’s retail sales index showed an increase over the previous month, but Japan is still struggling with an outbreak of the Delta strain. The number of new daily infections exceeded 25,000 for the first time this month. Japan is exploring the possibility of mixing AstraZeneca’s COVID-19 vaccine with vaccines developed by other drug product manufacturers in an effort to speed vaccine adoption.

Trading recommendations

Support levels: 109.43, 109.19, 108.65

Resistance levels: 110.11, 110.34, 110.66, 110.95, 111.48

The main trend of the USD/JPY currency pair is bullish. The decline in the dollar index led to the fall in USD/JPY quotes on Friday. But despite the decline, the USD/JPY currency pair is still trading in the corridor. Under such market conditions, traders should look for buy trades from the support level, where the buyers show initiative. Sell positions should be considered only on lower time frames from the resistance levels with short targets.

Alternative scenario: if the price falls below 109.18, the uptrend is likely to be broken.

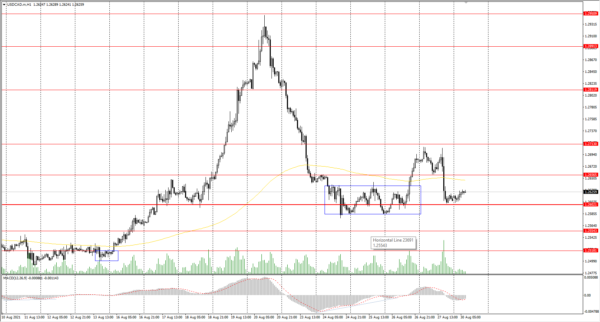

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.2681

Prev Close: 1.2609

% chg. over the last day: -0.59%

The Canadian dollar is a commodity currency, so the USD/CAD currency pair is highly dependent on the dynamics of the dollar index and oil prices. On Friday, after Jerome Powell’s speech, the dollar index went down, while oil prices remained at the same level. As a result, the USD/CAD currency pair declined.

Trading recommendations

Support levels: 1.2602, 1.2554

Resistance levels: 1.2656, 1.2713, 1.2812, 1.2891, 1.2951

In terms of technical analysis, the USD/CAD trend is still bullish but the price returned to the priority change level. The probability of a breakthrough of the support level is increasing. It is better to look for buy positions from the priority change level but after buyers show initiative. Sell positions can be considered from the resistance levels, but only with short targets throughout the day.

Alternative scenario: if the price breaks down through the 1.2602 support level and fixes below, the uptrend will likely be broken.