The USD/JPY plunged in the last two days, but now has opened with an immense gap up, signaling that the bulls are still in the game. Is trading in the green right now, but remains to see if the buyers will be strong enough to push it towards new highs, or this it was only a temporary rebound.

Price increased as the Nikkei stock index has jumped amazingly in the Asian session. The USDX has increased as well, but is premature to talk about a broader rebound. USDX is still under massive selling pressure, only an accumulation will bring more buyers in the market.

The Yen dropped on the mixed Japanese data, the M2Money Stock rose by 4.0% in August, less versus the 4.1% estimate, the indicator remained steady at 4.0%, while the Core machinery Orders surged by 8.0% in July, beating the 4.2% estimate.

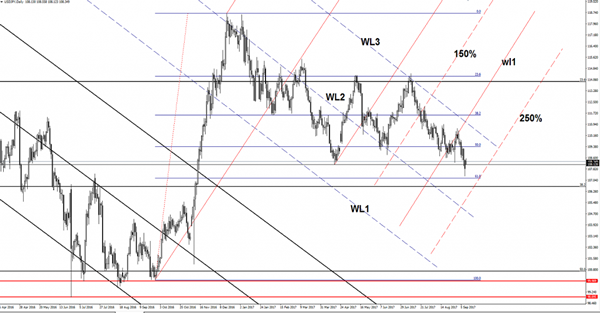

Price is trading in the green and struggles to stay above the 108.12 horizontal support. Has opened with a huge gap up, which could invalidate a further drop. USD/JPY failed to reach and retest the 61.8% retracement level. A false breakdown below the 108.12 level will signal a rebound at least till the third warning line (WL3) of the descending pitchfork.

Technically is still expected to reach the 250% Fibonacci line (ascending dotted line), where he could find support as well. Only a breakdown below this dynamic support and below the 38.2% resistance level will confirm a major drop, this scenario is less likely to happen. A broader drop will be confirmed after a valid breakdown below the upper median line (uml) of the ascending pitchfork.