AUD/USD dropped further after the yesterday’s bearish candle and should hit fresh new lows very soon. Price has found strong resistance, so the current drop is natural. The USD has taken the lead again as the USDX has rallied in the yesterday’s session.

We’ll see what will happen on the dollar index because the rebound could be only temporary. As you already know, the USDX remains under massive selling pressure despite the current bounce back. Only an accumulation could signal a reversal on the USDX.

The Aussie goes down also because the NAB Business Confidence was reported at 5 points in August, much below 12 points in the previous reading period. The economic indicator has reached the lowest level since December 2016. We’ll see how the pair will react after the release of the US data, the JOLTS Job Openings are expected to drop from 6.16M to 5.96M, while the NFIB Small Business Index decreased from 105.2 to 104.8 points.

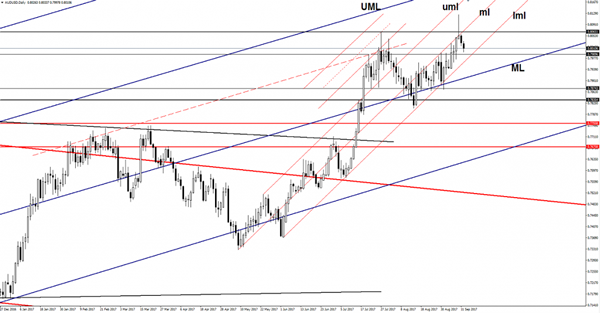

The pair has turned to the downside after the false breakout above the 0.8065 horizontal resistance and above the median line (ml) of the minor ascending pitchfork. The next downside target will be at the lower median line (lml) of the minor ascending pitchfork. A breakdown from the pitchfork’s body will send the rate towards the median line (ML) of the major ascending pitchfork, where he could find support again.