The GBP/USD changed little in the start of the week, but most likely we’ll have a significant move in the upcoming hours as the United Kingdom is to release the inflation data. Price has found temporary resistance on Friday and now could drop a little if the UK’s data will disappoint later. The USDX increased in the yesterday’s session and have forced the GBP/USD to decrease a little.

The dollar needs a strong support from the United States economy to be able to dominate the currency market again. The USD’s rebound is natural only because is too oversold to drop further without a minor bounce back.

The UK’s CPI is expected to increase by 2.8% in August and could beat the 2.6% in July, while the Core CPi should increase by 2.5%, exceeding the 2.4% in the former reading period.

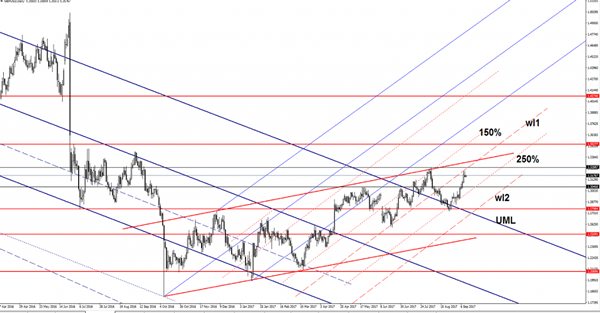

Price moves upwards within the ascending channel, so the perspective remains bullish on the Daily chart. GBP/USD has found temporary resistance at the first warning line (wl1) of the minor ascending pitchfork and much below the 1.3266 previous high. The GBP/USD will be driven by the fundamental factors in the upcoming hours, so the direction is still uncertain on the short term.

A failure to climb above the 1.3266 previous high will signal another leg lower. Technically should reach the upside line of the ascending channel and even to jump above it after the failure to approach and retest the downside line of this pattern.