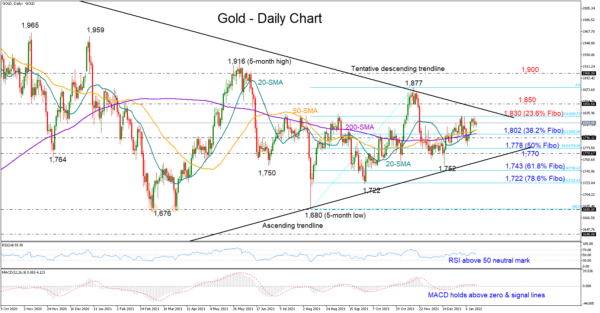

Gold has been trading at a sluggish pace below the tough 1,830 resistance zone for the past three weeks, but the latest upturn in the price could show more resilience according to the technical picture.

With the RSI fluctuating within the bullish territory and the MACD standing above its signal and zero lines, the bias is skewed more to the upside than to the downside. Also, the progressing bullish cross between the shorter and longer-term simple moving averages (SMAs) is raising hopes for trend improvement in the market. But a confirmation signal could only come above the 1,830 bar, where the tentative descending trendline drawn from the record top of 2,079 is currently intersecting the 23.6% Fibonacci retracement of the latest upleg (1,680 – 1,877).

A sustainable move above 1,830 could clear the way towards November’s high of 1,870, unless the 1,850 barrier cools buying pressures. Further up, all eyes would shift to the 1,900 – 1,916 region, a break of which is required to upgrade the neutral medium-term picture, and hence bring the 2021 top of 1,959 under the spotlight.

On the downside, a close below the 1,800 round-level could confirm another decline towards the 50% Fibonacci of 1,778 and the 1,770 support area. Note that an ascending trendline stretched from the 2020 lows is around this neighborhood. Hence, any significant violation here could sharpen selling interest, likely pressing the price immediately within the 1,743 -1,722 territory. Should the sell-off gain extra legs, the door would open for the five-month low of 1,680.

In brief, gold’s short-term bias is still within the positive territory despite the soft pullback from 1,830 last week, suggesting that the bulls have not abandoned the game yet.