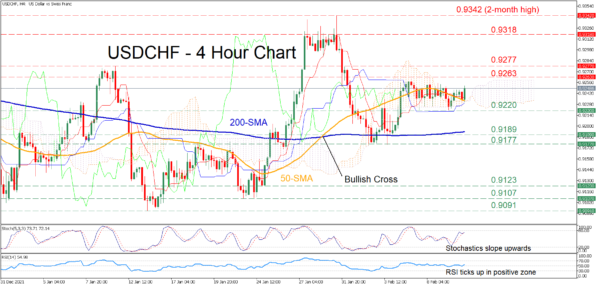

USDCHF has recovered some lost ground after its short-term decline ceased at the 0.9177 region. However, in the last few four-hour sessions, its ongoing rebound seems to be faltering as the price has adopted a more sideways pattern.

The momentum indicators suggest that bullish forces are still prevailing. More specifically, the stochastic oscillator is sloping upwards, while the RSI is ticking up above its 50-neutral mark. Additionally, the price is currently trading above the Ichimoku cloud, confirming the broader bullish near-term picture.

Should the positive momentum intensify further and the price ascends, initial resistance might be encountered at the recent high of 0.9263. Crossing above this level, the spotlight could turn to the 0.9277 barrier. If upside pressure persists, the price could jump towards 0.9318, a level which the price has failed to close above on multiple occasions in the recent past.

On the flipside, if bearish forces manage to regain the upper hand, the price may meet immediate support at the recent low of 0.9220. Diving below this region, the 0.9189 hurdle could appear on the radar. Failing to halt there, the price could dip towards the 0.9177 crucial support point, before the bears aim for the 0.9123 obstacle.

Overall, USDCHF has been moving without a clear direction in the last few sessions, but the short-term oscillators indicate that the directional forces are tilted to the upside. Therefore, a clear break above the 0.9263 ceiling is needed to signal the resumption of its recent rebound, whereas a dive below 0.9177 could endorse the short-term downside trajectory.