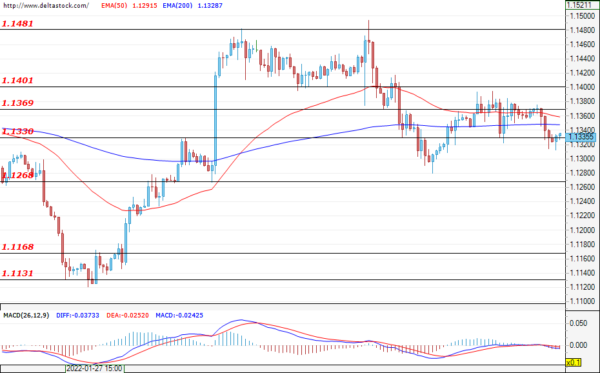

EUR/USD

The test of the support zone at 1.1330 was not successful, and during the early hours of today`s trading, the pair is trading above the mentioned level. If the bulls prevail, then the expectations will be for an attempt to breach the resistance zone at 1.1369. If the bulls are successful and manage to breach the next target at 1.1401 as well, then we will most likely witness a rally towards the level at 1.1481. If, however, the bearish attack continues and they manage to violate the support of 1.1330, then the sell-off could easily deepen towards the important support at 1.1268. The situation in Ukraine will most likely be the main factor driving the markets during this week.

USD/JPY

On Friday, the bulls did not gain enough momentum and the recovery was limited to the zone at 115.26. The dollar erased some of its recent gains against the yen, and at the time of writing, the pair is consolidating around the support zone at 114.97. If the bears breach the mentioned level, then a continuation of the sell-off would be the most probable scenario. Violation of the target at 114.74 should strengthen the negative expectations for the future path of the Ninja and will most likely lead to a test of the support at 114.25. The first target for the bulls is still the level of 115.26, followed by the upper resistance at 115.69.

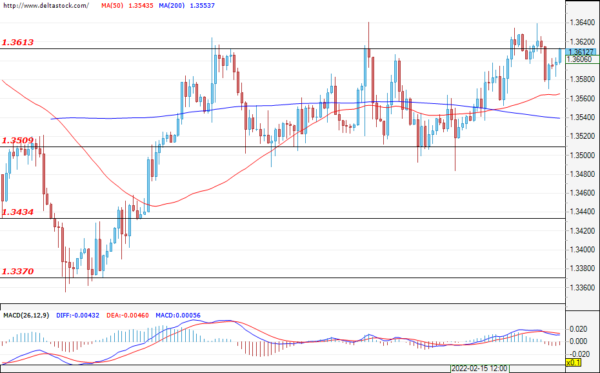

GBP/USD

The positive sentiment remained unchanged, and during the early hours of today`s trading, the Cable is re-testing the resistance zone at 1.3613. A successful violation of the aforementioned zone could easily lead to new gains for the pound against the dollar and could help for a rally towards the upper target at 1.3650. The first support can be found at the level of 1.3509, followed by the lower zone at 1.3434.

EUGERMANY40

The bears could not breach the psychological level at 15000. If the bearish momentum fades and the bulls breach the resistance level at 15297, then the rally will most likely extend above 15459, drawing a more bullish picture for the index.. If the bears re-enter the market, however, then a new test and a breach of the support at 15075 will be the most probable scenario. This could easily deepen the drop, leading to a move towards the support at 14839. This week, the Russia-Ukraine conflict will be the main force driving the price action and any positive news on that front should lead to a strong rally – and vice versa.

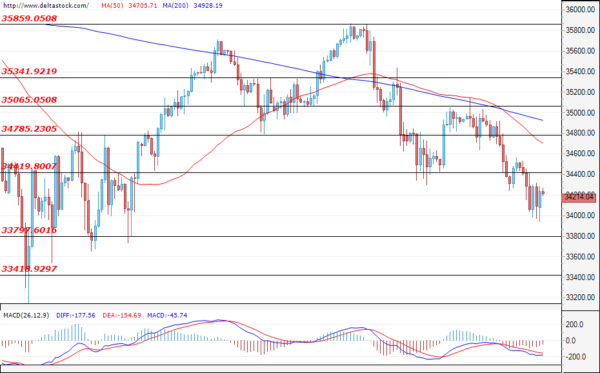

US30

The expectations for the U.S. – Russia summit helped the U.S. index to recover from its lower open at the start of the trading week. At the time of writing, the price is hovering around 34226, and if the bulls take control, then they will most likely try to breach the level at 34419, which is currently acting as resistance. The first target for the bears is the support zone at 33797, followed by the lower level at 33418. The data for the U.S. consumer confidence (Tuesday; 15:00 GMT), as well as the initial jobless claims data (Thursday; 13:30 GMT) should lead to an increase in volatility this week.