The dollar regained traction in early Thursday’s trading after post-Fed’s 0.9% drop was contained by rising 10DMA, signaling that weakness is likely to be short-lived and dips to offer better buying opportunities for robust dollar.

In a widely expected action, the US central bank raised its benchmark rate by 50 basis points and showed readiness for 0.5% hikes at upcoming policy meetings in June and July.

The Fed also signaled it would start to reduce its roughly $9 trillion balance sheet as from next month, in attempts to put high inflation under control, balancing between requirement for strong response on rising inflationary pressures and cautiousness to avoid pushing the economy into recession on too strong response.

Fed chair Powell said that the central bank was not planning any stronger hike in coming meetings, pouring cold water on expectations for more aggressive action, after speculations that the central bank may opt for 0.75% raise.

The greenback remains firm despite the Fed’s action disappointed many who bet for hikes above expectations that would further widen the gap between the Fed and other major central banks.

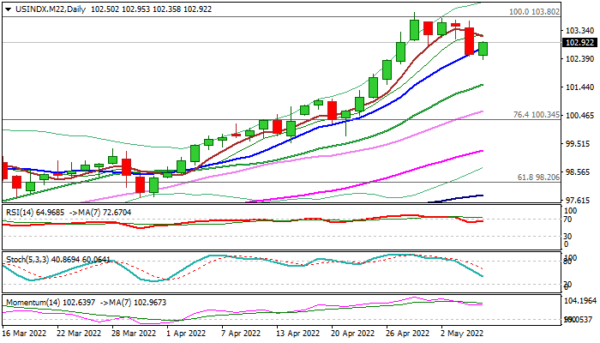

Technical studies remain bullish overall, but show easing bullish momentum that would keep the dollar index in extended consolidation under key barriers at 103.80 (2017/20/22 peaks) before bulls eventually break higher.

Repeated close above 10DMA to signal an end of shallow correction and confirm bulls are intact, while dip below 10DMA would keep a scenario of deeper pullback in play.

Rising 20DMA (101.50) marks next significant support, which guards lower pivots at 100.82/56 (daily Kijun-sen / Fibo 38.2% of 95.12/103.93).

Res: 103.15; 103.80; 103.93; 104.65.

Sup: 102.35; 101.85; 101.50; 101.01.