EUR/USD

After the breach of the support at 1.0482 yesterday, the European common currency lost quite a bit of ground against the dollar and the pair tested the lower level of support at 1.0364. During the early hours of today`s trading, the pair is hovering above the mentioned zone, but if the bearish attack continues, then a successful breach of the level at 1.0364 could easily lead to new losses and strengthen the negative expectations for the future path of the EUR/USD. If the bulls enter the market, then their first target would be the zone at 1.0482, which is now acting as resistance, followed by the level at 1.0580.

USD/JPY

The depreciation of the dollar against the yen was limited to the support zone at 127.63 where the bulls re-entered the market. At the time of writing the analysis, the Ninja is confirming the breach of the resistance zone at 128.82, and if this proves to be the case, then an attack on the next target at 130.45 would be the most probable scenario. A successful violation here could easily continue the recovery towards the high at 131.22. If the bears take control, their first support can be found at the zone at 128.82. Only a breach of the lower target at 127.63, however, could lead to a change in the current sentiment of the market participants.

GBP/USD

The British pound continued to lose ground against the U.S. dollar, and during the early hours of today`s trading, the Cable is consolidating above the important support coming from the higher time frames – the zone at 1.2171. A breach for the bears could continue the depreciation of the sterling against the greenback and could easily head the price towards the levels from May 2020 at around 1.2120. If the bearish momentum fades, then the bulls could lead the pair for a test of the zone at 1.2275, followed by the upper target at 1.2403.

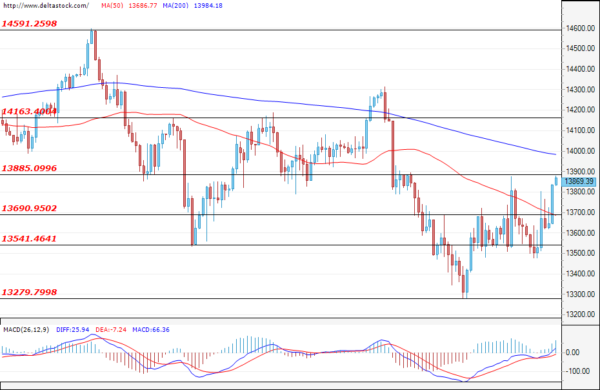

EUGERMANY40

The German index regained some of its recent losses, and at the time of writing, it is headed for a test of the important resistance zone at 13885. A successful violation for the bulls could easily continue the recovery towards the next level at 14163, where a breach could strengthen the positive expectations for the future path of the index. If the mentioned zone at 13885 withholds the bullish attack, however, then the bears could attempt to violate the first support at 13690, followed by the lower target at 13541.

US30

Just like the other indices around the world, the US30 appreciated, and during the early hours of today`s trading, the price is holding positions above the zone at 31889. If the bulls continue to prevail, then a test of the upper target at 32582 is a highly probable scenario. Only a violation of the resistance at 33015, however, followed by a breach of the zone at 33307, could strengthen the positive expectations and could lead to a more sustained rally and an attack on the major resistance at 34122. If the bears re-enter the market, then a new successful attempt at breaching the support at 31227 could define the current move as corrective and could deepen the decline towards the zone from January 2021 at around 31000.