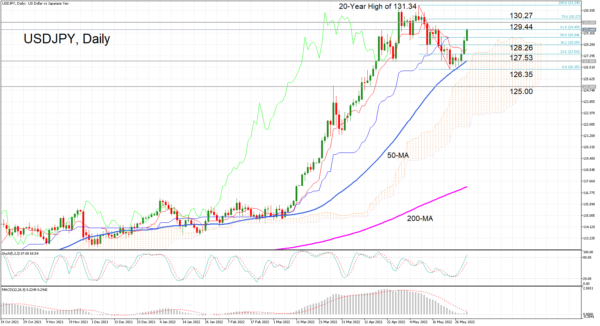

USDJPY is headed for a fourth straight day of gains, having glided off the 50-day moving average (MA) after tumbling to a one-month low of 126.35 on May 24. The pair has now retraced more than half of the May downleg, reaching the 61.8% Fibonacci of 129.44.

The momentum indicators suggest that further gains are possible in the near term. The stochastics are on a decisive path upwards. However, the %K line has crossed into overbought territory, hinting the possibility that the rally could soon run out of steam. In contrast, the MACD histogram has yet to rise above its red signal line, suggesting that the rebound hasn’t gone far enough.

But for the bulls to power ahead, they would first have to overcome the immediate resistance of the 61.8% Fibonacci. A successful break above it would shift focus to the 130 handle and the 78.6% Fibonacci of 130.27. Clearing this hurdle too would set USDJPY on course to re-test the two-decade of 131.34.

A climb above this top is necessary to restore the medium-term uptrend, as the outlook is at risk of turning neutral as the price approaches the Ichimoku cloud.

To the downside, the 38.2% and 23.6% Fibonacci retracements of 128.26 and 127.53, respectively, could stymie any selloff attempts before the price approaches the critical 50-day MA again, which currently stands just at the 127 level. Dropping below 127 would open the way for the 125 barrier, which coincides with the March peak. If this support fails, the medium-term outlook would start to turn more bearish.

To sum up, USDJPY seems to have enough bullish momentum at the moment to revive the Spring rally, but it would first need to surpass May’s 20-year high. If, though, it were to succumb to negative pressures again, the 50-day MA and 125 level would be key in staving off the bears.