EUR/USD

On Thursday, the session started promisingly and, from the very beginning, the euro managed to rise to the key level of 1.0765. However, this level is the upper end of the range in which the currency pair has been locked in since the end of May. Right after ECB’s decision to keep the key interest rate unchanged at 0.00%, the bears attacked without delay. Their strength was so immense that they even managed to break the lower end of the range 1.0643 and the day ended in a new weekly bottom of 1.0617. The last day of the week is important for the single European currency, because traders expect CPI data from the United States at 13:30 GMT. If expectations for the inflation rising with 0.7% are confirmed, the dollar may continue to rise and the euro to move to the next support level 1.0545. The possibility of a weak dollar and the pair returning to the mentioned levels of the range should not be ruled out.

USD/JPY

In the early hours of Thursday, the yen peaked at 134.45 and began a correction, which with the opening of the European session continued to the key level of 133.16. There, the bulls in the dollar found support again and raised the currency pair back to the mentioned peak of 134.45. Whether the growth will continue and whether we will see a new weekly peak, depends on the traders’ reaction to the U.S. inflation data at 13:30 GMT. The opposite scenario and the deepening of the correction should not be ruled out as the levels of 132.33 may be reached again, if the reaction is negative.

GBP/USD

The sterling session was similar to the euro session, with an increase at the beginning of the day. The currency pair reached the support at 1.2557 and when the euro began to fall due to the rise of the dollar, the pound did not remain unaffected and headed down to the bottom of its weekly range of 1.2470. The bears’ momentum wasn’t enough to reach the support at 1.2470. Whether the growth of the dollar will continue and the bottom of the range will break, depends on whether the reaction of traders to the dollar will be positive, after the release of the U.S. CPI data at 15:30 EEST today. However, if they are disappointed, the bulls in the cable can take advantage of this and raise it to 1.2600.

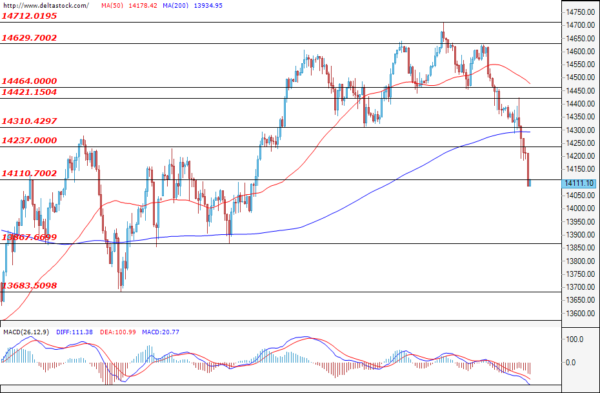

EUGERMANY40

After reaching a peak of 14712 on Monday, EUGERMANY40 took a downward trend and each rise simply gives a good price for a new entry for the bears in the stock market. The session on Thursday started with a slight increase to 14420, but it was just a good price for new shorts. After ECB’s decision to keep the key interest rate unchanged, the index plunged, broke the level of 14237 and ended the day with a new bottom of 14111. This level is extremely important because it will either form a support zone, or may end the week below 14000.

US30

With the opening of the U.S. session on Thursday, the blue-chip index tried to bounce back to the prices it reached during the European session, namely 33120. However, the bears took complete control soon after the data regarding the unemployment claims at 13:30 GMT was worse than expected.. Тhis led to a decline in the price of the index and it broke two key levels along the way – 32775 and 32531. The day ended in red after a huge pressure and a drop of nearly $500. Whether prices around 32325 will support the index and bring it back depends on the U.S. inflation data at 15:30 EET on Friday. However, if traders accept them negatively, we may see a new weekly bottom at around 32000.