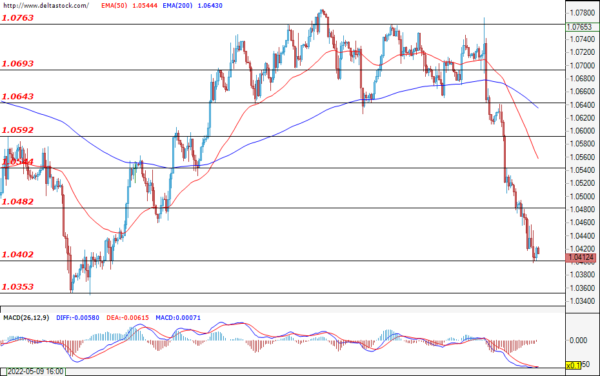

EUR/USD

The single European currency continues to lose ground against the U.S. dollar as the breach of the 1.0480 support zone from the previous session gave additional impetus to the bears. They, in turn, without hesitation led the market towards the area of the next significant support at 1.0400. The return of the bulls will be relatively difficult with such a predominantly bearish sentiment. The first important resistance for the buyers is the 1.0480 zone, with the most likely scenario at the moment being for a consolidation at around the current level. Today, volatility will most likely spike after the announcement of the PPI for the U.S. at 12:30 GMT.

USD/JPY

After the significant appreciation of the U.S. dollar against the Japanese yen, the currency pair formed a support level at 134.45, which managed to withstand the bulls’ pressure and the currency pair is currently consolidating in the range of 133.16 – 134.45. In case the bulls manage to regain control over the market and successfully violate the mentioned support, then this would strengthen the positive expectations for a continuation of the uptrend and the next target for the bulls would be the psychological level at 135.00. On the other hand, if the bulls’ attack is thwarted, then the first significant support level for the sellers would be at 133.16.

GBP/USD

After the successful breach of the critical support at 1.2260, the bears’ momentum was strong enough to lead the pair towards a test of the support at 1.2120. At the time of writing this analysis, the pair is hovering just above this level, and the expectations for today’s trading session are for the pair to bounce back from this level and for us to witness a slight correction towards the local resistance at 1.2200. However, a successful breach of the critical support at 1.2120 may result in another decline towards the key one at 1.2040.

EUGERMANY40

The bears continued to dominate the European markets, as over the past week they managed to deepen the sell-off and caused a decline of almost 700 points in the German index. During yesterday’s trading session, the bulls managed to limit the decline to around the support at 13350 and a corrective move towards 13683 is shaping up to be a highly likely scenario before the bearish pressure is to continue. Nevertheless, the expectations are for the sell-offs to deepen and for the index to head towards a test of the psychological level at 13000, but this scenario would become possible only after a successful breach of the support at 13350.

US30

During yesterday’s trading session, the decrease in the price of the index continued, but at the time of writing, the bulls have managed to limit the sell-offs to just above the support level at 30500. If the bears prevail and overcome this level, then we may expect a further decline towards the support at 30000. However, before a possible resumption of the downtrend is to take place, we could first witness a price correction towards the resistance zone at 31000. The market sentiment remains strongly negative and the most probable scenario at the moment is for the index to continue to lose its value as a result of the rising interest rates, Russia’s war on Ukraine, and China’s COVID-related lockdowns.