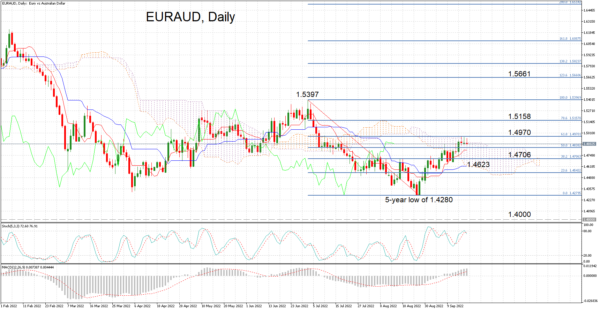

EURAUD has lost some upward momentum over the last three days as the rebound from August’s five-year trough hit a wall at the top of the Ichimoku cloud. This region also coincides with the 61.8% Fibonacci retracement of the July-August downtrend at 1.4970.

Looking at the momentum indicators, the setback appears to be just a pause for breath at this point. The stochastics are only slightly dipping downwards despite the bearish crossover of the %K and %D lines, while the MACD histogram continues to climb above zero and is positively aligned with its red signal line. More importantly, price action remains confined near the cloud top.

If the bulls are able to regain the upper hand and push the price above the 61.8% Fibonacci, the next test will be the 78.6% Fibonacci of 1.5158, followed by the July top of 1.5397. Surpassing this peak would shift the spotlight to the 123.6% Fibonacci extension of 1.5661, after which further gains would see the short-to-medium-term picture becoming bullish.

However, if EURAUD loses further steam and drops inside the cloud, there could be support in the 1.4700 region, which lies slightly below the 38.2% Fibonacci. The Kijun-sen line at 1.4623 near the cloud’s lower surface could be important too and if breached, the August low of 1.4280 could be the next stop. Below this point, sellers would likely focus their attention on the psychologically crucial support point of 1.4000.

To sum up, if the latest rebound is able to resume soon, there is potential for a more sustainable uptrend. But if the pair pulls back towards the August trough, the current neutral outlook would be at risk of turning bearish.