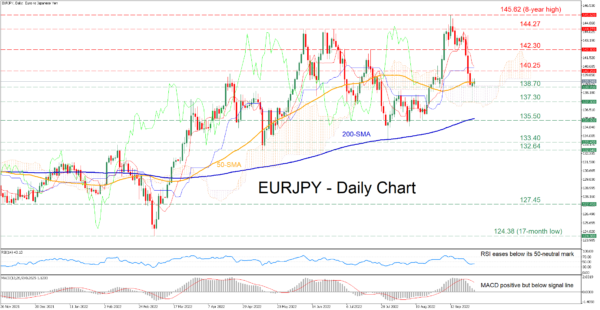

EURJPY has been experiencing a sharp drop after its latest advance came to a halt at the eight-year high of 145.62. However, in the last couple of sessions, the pair has managed to stop its bleeding as the 50-day simple moving average (SMA) has been acting as a strong floor.

The short-term oscillators currently suggest that near-term risks are tilted to the downside. Specifically, the RSI is flatlining below its 50-neutral mark, while the MACD histogram is retreating below its red signal line but remains in the positive zone.

If the price profoundly crosses below its 50-day SMA, the recent support zone of 138.70, which overlaps with the upper boundary of the Ichimoku cloud, might act as the first line of defence. Should that floor collapse, the pair could descend towards the recent low of 137.30. Any further drop could then cease at 135.50 before the July low of 133.40 comes under examination.

To the upside, bullish moves could encounter immediate resistance at the 140.25 barrier. A break above the latter could turn the spotlight to 142.30, which has acted both as resistance and support in the last two months. Failing to halt there, the bulls may aim at the June peaks of 144.27 before the eight-year high of 145.62 appears on the radar.

Overall, despite its recent retreat, EURJPY retains its positive short-term picture. Nevertheless, a clear close beneath the 50-day SMA could ignite further selling interest, increasing sellers’ hopes for a sustained downfall.