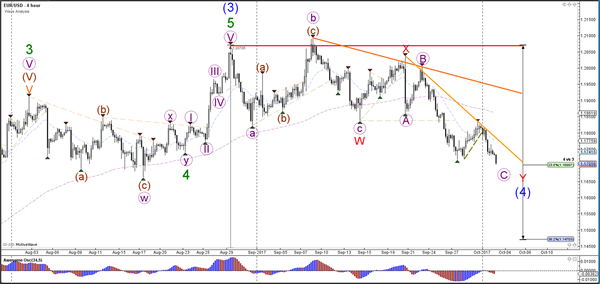

Currency pair EUR/USD

The EUR/USD is trying to break below the 23.6% Fibonacci level. could create a larger ABC (green). A bearish breakout could see price fall towards 1.15 at the 38.2% Fibonacci level of wave 4 vs 3, which in turn could act as potential support.

The EUR/USD bullish corrective pattern did not take place as price failed to break above the resistance trend lines (red/orange). Instead, price broke below the previous bottom which could indicate that price is in a wave 3 (grey) of wave C (purple). A break above the resistance trend lines would invalidate the bearish outlook.

Currency pair GBP/USD

The GBP/USD broke below the 38.2% Fibonacci level and indeed made a bearish breakout towards the 50% Fib of wave 4 vs 3 and the support trend line (blue) as mentioned yesterday. The 1.3250 is an important support zone as they are two trend lines (blue) and a 50% Fib of wave 4 vs 3.

A bullish bounce could price test the of the bearish channel whereas a bearish breakout could see price fall towards the 61.8% Fib of the 4 hour chart. A bullish bounce could face resistance from the Fib levels (green) and from the channel resistance. A breakout above these resistances makes a larger bullish move more likely.

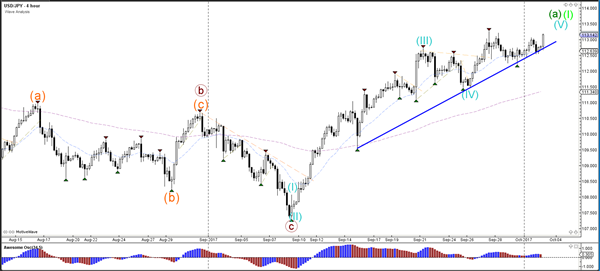

Currency pair USD/JPY

The USD/JPY bounced again at the support trend line (blue), which could indicate the continuation within wave 5 (blue).

The USD/JPY broke above the resistance trend line (dotted orange) and seems to be heading towards the Fibonacci targets of wave 5 (purple).