Hello, my beautiful readers. This week, we continue our critically detailed look at the markets in hopes of getting profitable trading opportunities. As usual, I’ll be starting with the DXY (US Dollar Index) since it holds considerable sway over the Major currency pairs.

As we can see from the attached image above, DXY seems to be gathering momentum to enable it to break out of the wedge pattern and recover its bullish momentum. This means that the US Dollar is expected to get stronger if this analysis is adhered to.

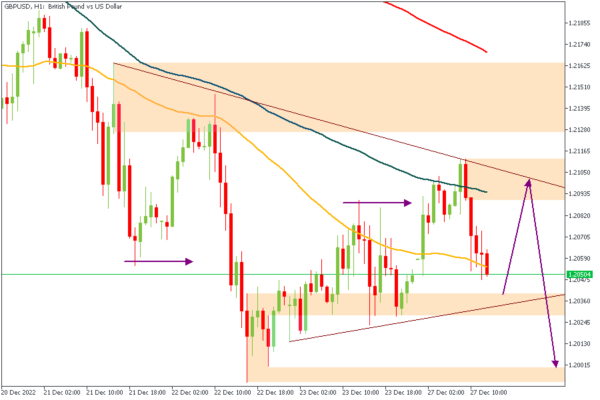

GBPUSD

GBPUSD is also currently merry-ing within the wedge, but with a recent break of the previous high at the marked horizontal arrow. Coupling this with our expectation of a stronger Dollar means we should be seeing some bearish price action on GBPUSD in a short while.

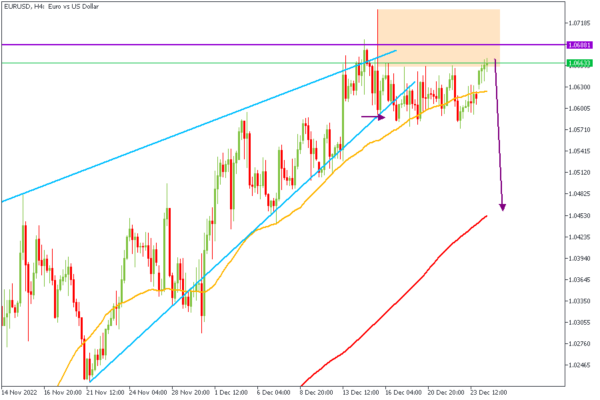

EURUSD

EURUSD on the other hand presents an interesting challenge. The market structure appears to be completely nonsensical, but the direction is still discernible to trained eyes. The marked horizontal arrow is the previous break of lows that occurred after the initial price rejection from the Daily supply zone as indicated by the horizontal purple line. As a result, I am expecting price to react from the highlighted area in continuation of the bearish structure and rejection from the supply zone.

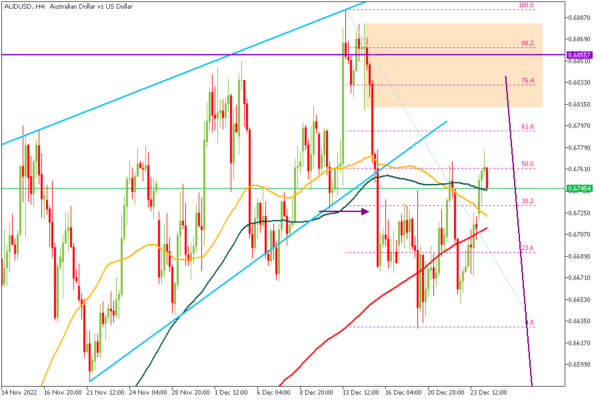

AUDUSD

Here we see a previous break out of the wedge, as well as a break of market structure. This means we can expect a textbook break-and-retest to play out here. The highlighted zone serves as my expected Point-of-Interest for a SELL entry.

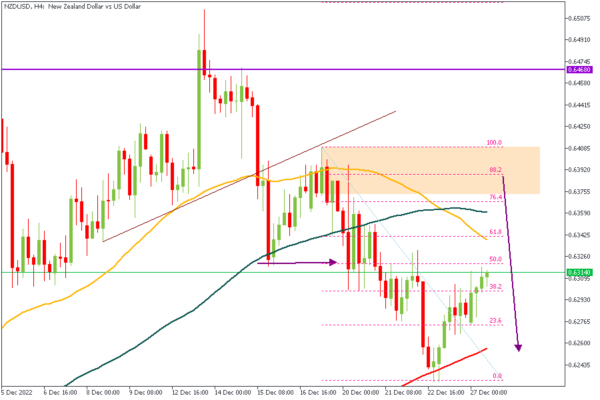

NZDUSD

Considering the ‘death cross’ on the chart above, having a bearish bias seems like a good idea. However, NZDUSD has provided us with further confirmations; we see the bearish break of structure at the marked horizontal arrow, and the Fibonacci retracement level around the vicinity of the 100-SMA on the 4-Hour timeframe. I will be waiting patiently for price to raid my zone before taking a Sell trigger.

CONCLUSION

It is important to understand that with the current festivities around the world, market volumes are naturally going to be on the low, so you should be careful to consider this in your trading. Also, the trading of CFDs comes at risk; if not properly managed, you may lose all of your trading capital. To avoid costly mistakes while you look to trade these opportunities, be sure to do your own due diligence and manage your risk appropriately.