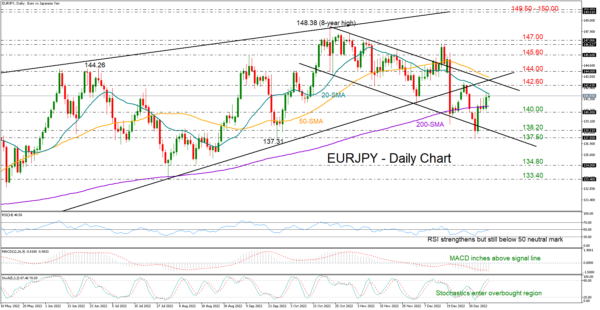

EURJPY rose as high as 141.91 after charting a three-month low of 137.37 at the lower boundary of a bearish channel.

The pair switched into gains in January after two negative months, and although the positive slope in the momentum indicators raises hopes for more upside ahead, room for improvement could be limited as the channel’s upper trendline is within a breathing distance at 142.60. Prior to that, the 20-day simple moving average (SMA), which is capping bullish actions for the second consecutive day at 141.75, could immediately ruin the recovery phase. Note that the RSI has yet to climb above its 50 neutral mark despite moving higher, while the stochastics are entering the overbought region.

Should the price exit the channel on the upside, all eyes will shift to the support-turned-resistance trendline from March 2022 at 143.30. This is where the 50-day SMA is heading. Hence, a clear extension higher and beyond the 144.00 hurdle could confirm additional gains up to 145.60.

If buying interest fades immediately, the price may reverse south to retest the 200-day SMA and the 140.00 number. A step lower could spark an aggressive decline towards the channel’s support line seen at 138.20, while a steeper bearish correction could reach the 137.50 floor as well.

Summing up, the latest rebound in EURJPY may have more room to run, though whether the bulls will escape the bearish structure remains to be seen.