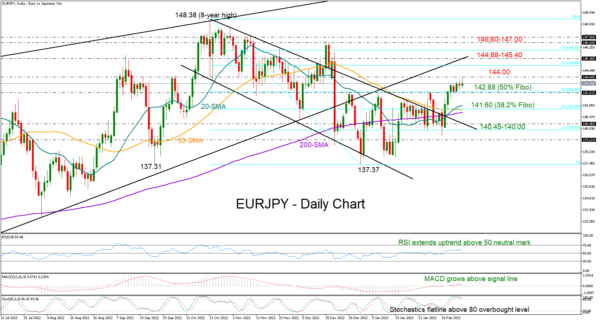

EURJPY gained new traction on Tuesday, breaking its short-term consolidation phase to print a new two-month high of 143.98.

There is more room for improvement according to the technical oscillators as the RSI is expanding above its 50 neutral mark and the MACD continues to strengthen above its red signal line. Meanwhile, the stochastic oscillator has already entered the overbought region above 80 but has yet to show any convincing signs of weakness, keeping the bias on the bullish side as well.

A decisive close above the 144.00 round-level is expected to bolster buying pressures towards the support-turned-resistance trendline from March 2022 seen around 145.40, while slightly lower the 61.8% Fibonacci retracement of the 148.38-137.37 downleg at 144.88 may attempt to pause the rally beforehand. Additional gains from here may then challenge the 146.60-147.00 ceiling ahead of the eight-year high of 148.38 registered last October.

On the downside, the pair seems to have established a floor around 142.88. If sellers press the price beneath that base, which coincides with the 50% Fibonacci level, the spotlight will fall on the 38.2% Fibonacci zone of 141.60. A steeper decline could squeeze the pair below its simple moving averages (SMAs) and towards the surface of the broken bearish channel seen around 140.45. The 23.6% Fibonacci area of 140.00 may be the last opportunity to change direction before a new bearish wave starts again within the channel.

Summing up, the recovery in EURJPY is expected to continue in the short term once the price peaks above 144.00. Alternatively, a step below 142.88 may shift attention back to the downside.