The Euro remains at the back foot in early Friday and on track for a weekly loss of around 1%, which adds to negative near-term outlook.

Risk aversion keeps the single currency under pressure, as US dollar received fresh boost from hawkish stance of the Fed.

The data released today, showed stronger than expected contraction of the German economy and along with recent weaker than expected economic data, adding to signals that Eurozone’s largest economy likely slid into recession in the first three months of 2023, which contributes to pressure on Euro.

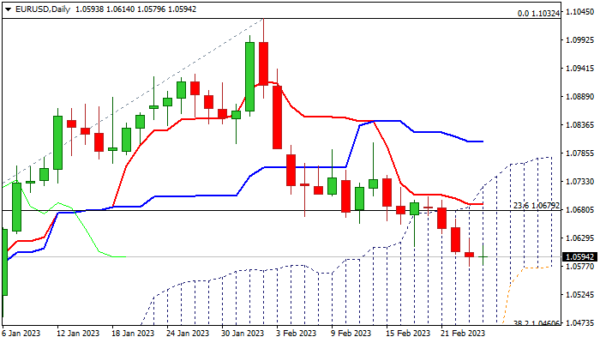

The daily chart shows the EURUSD pair heading south, deep in thick daily Ichimoku cloud, with bearishly aligned studies adding to prospect of further weakness.

Bears eye initial support at 1.0544 (daily cloud base), break of which would unmask next key levels at 1.0483/60 (2023 low, posted on Jan 6 / Fibo 38.2% of 0.9535/1.1032 ascend).

Meanwhile, bears may take a breather for consolidation, as stochastic is oversold and 14-d momentum bounced, but remaining in the negative territory.

In such configuration, limited upticks, which would offer better levels to re-join bearish market, would be likely scenario.

Falling 10DMA (1.0663) and broken Fibo 23.6%, reverted to resistance (1.0679), should ideally cap extended upticks and guard upper pivot at 1.0742 (daily cloud top).

Res: 1.0627; 1.0663; 1.0679; 1.0715.

Sup: 1.0577; 1.0483; 1.0460; 1.0443.