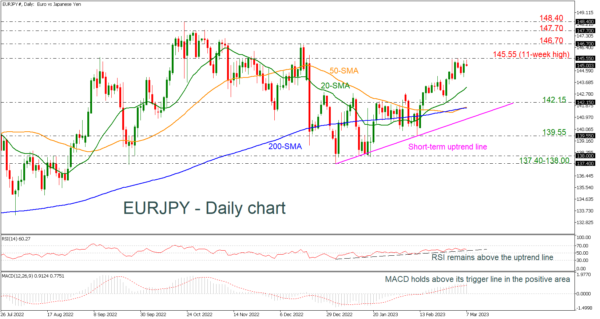

EURJPY has reversed back down again after finding resistance at the 11-week high of 145.55 achieved at the end of December. However, the market is still developing above the short-term uptrend line that has been drawn from the beginning of January.

Technically, the momentum indicators are pointing to a neutral to positive bias in the short term with the RSI just above the uptrend line and the MACD standing above its trigger and zero lines.

Any losses should see the 20-day simple moving average (SMA) at 143.30 acting as a major support ahead of the 142.15 line. Marginally lower, the 50- and the 200-day SMAs at 141.75 would reinforce the bearish structure if the price breaks it and drops beneath the uptrend line at 141.00 as well.

In the event of an upside reversal, the 145.55 mark could act as a barrier before being able to re-challenge the 146.70 resistance. Further gains could lead the way towards the 147.70 and the 148.40 obstacles.

Summarizing, EURJPY is looking bullish in the near-term and only a selling interest below the ascending line may switch the outlook to bearish.