Gold opened higher and above its 50-day simple moving average (SMA) on Monday, stretching Friday’s impressive 2% rally, which was the fastest daily run since November 10, up to a five-week high of 1,894.

The precious metal restored its safe-haven feature in the wake of the Silicon Valley Bank’s fallout, quickly recouping last Tuesday’s freefall as investors questioned whether the Fed will be able to deliver a 50 bps rate hike this week.

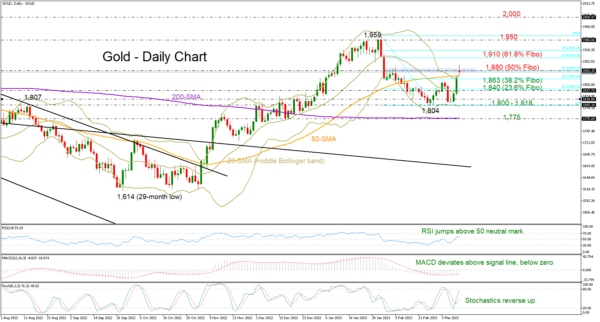

Technically, the swift upturn pushed the price back into the bullish area. The RSI has jumped back above its 50 neutral mark, while the MACD has strengthened above its red signal line. Yet, with the price trading above the upper Bollinger band – a sign that the latest advance is overdone – there is potential for a downside correction.

Note that the technical indicators on the four-hour chart are flagging overbought conditions.

The 1,880 region, which overlaps with the 50% Fibonacci retracement of the 1,959-1,804 downleg, is currently limiting bullish actions. The area had been a key barrier to upside movements a year ago. Therefore, a decisive close above it is probably required to drive the price towards the 1,900 psychological mark and the 61.8% Fibonacci zone. Running higher, the bulls will aim to resume the uptrend from October above the 1,950 bar. If they succeed, the next resistance could be the crucial 2,000 level.

In the bearish scenario, where the price slides back below the 50-day SMA and the 38.2% Fibonacci level of 1,863, the focus will shift to the 23.6% Fibonacci of 1,840 and the 20-day SMA (middle Bollinger band). Failure to pivot here could squeeze the price back into the 1,818-1,800 region.

All in all, gold seems to have entered a bullish territory, though the resistance around 1,880 could still motivate some profit taking.